In a war, the detachment from one’s actions can be seen rather clearly. Consider, for example, the example of Apache Attack helicopters in Iraq, where pilots, shielded by screens and distance, unleash destruction with a startling lack of visceral connection to the lives they alter.

In a war, the detachment from one’s actions can be seen rather clearly. Consider, for example, the example of Apache Attack helicopters in Iraq, where pilots, shielded by screens and distance, unleash destruction with a startling lack of visceral connection to the lives they alter.

Rather than feeling as though they were killing people, they felt as if they were playing a computer game. It is a stark example of how technology can create a buffer between actions and consequences, blurring the lines of accountability. This phenomenon, known as abstraction, extends its reach far beyond the battlefield.

In the realm of gambling, an arena that hinges on risk and reward, financial abstraction is a potent force. In an age where wagers are no longer predominantly settled in cash but within the digital realm thanks to apps and online betting, the implications for our understanding of money and its value are profound.

Moreover, the advent of cryptocurrencies introduces a double layer of detachment, distancing us even further from the tangible reality of our stakes. This shift in the nature of monetary transactions has found expression in the very tools casinos employ, such as chips and tokens that remove themselves from the hard currency they actually represent.

Understanding Financial Abstraction

In a world increasingly defined by digital transactions and virtual currencies, the concept of financial abstraction has taken centre stage. In its simplest terms, financial abstraction refers to the degree of detachment you can experience from the tangible form of currency used in a transaction.

In a world increasingly defined by digital transactions and virtual currencies, the concept of financial abstraction has taken centre stage. In its simplest terms, financial abstraction refers to the degree of detachment you can experience from the tangible form of currency used in a transaction.

Unlike the physical exchange of bills and coins, abstracted financial interactions occur in the digital realm, often mediated by screens, codes and algorithms. This shift is particularly palpable in the world of online gambling, which tends to be done on an app or via a computer screen.

Traditional brick-and-mortar casinos have always offered a slight sense of abstraction thanks to the chips that tend to be used to bet with. Even so, they have now given way to virtual platforms, where bets are placed and winnings are collected through clicks and keystrokes.

The very essence of money, once a palpable representation of value, now exists as streams of binary code, represented by numbers on a screen. Whilst chips are removed from cash, they are at least physical and tangible and tend to be swapped for real money at the end of your time spent gambling.

To illustrate the depth of this transformation, look closer at the casino chip. A seemingly innocuous token, it carries significant symbolic weight. When we place chips on the betting table, we are engaging with a form of financial abstraction.

The chip stands as a surrogate for the actual money it represents, creating a layer of detachment that can alter our perception of risk and reward. It is a psychological buffer, a means of compartmentalising our financial stakes, allowing us to play the game with a certain degree of cognitive distance. In the digital realm, though, this abstraction is amplified.

When we place bets online, the absence of physical currency further removes us from the reality of our wagers. Numbers on a screen become stand-ins for the money we are putting at risk. The visceral sensation of holding cash, feeling its weight and texture, is replaced by the intangible glow of pixels. This transition from tangible to abstracted currency has profound implications for our decision-making processes, influencing how we perceive and respond to wins and losses.

As financial transactions become increasingly digitised, the degree of financial abstraction continues to evolve.

The emergence of cryptocurrencies has brought in an entirely new layer of detachment. When we deposit and bet using cryptocurrencies, we’re engaging in a form of double abstraction. These digital currencies, existing only in the virtual realm, can feel even more removed from the physical world of bills and coins than the depositing of cash from our bank account will do.

In this landscape, understanding the nuances of financial abstraction is essential. It is not merely an academic concept, but a fundamental aspect of our modern financial interactions.

The Psychology of Financial Abstraction

To comprehend the profound impact of financial abstraction, it is important to delve into the intricate workings of the human mind. Our perception of money, and consequently our behaviour in financial transactions, is deeply influenced by psychological factors that come into play when the tangible nature of currency is replaced by its digital representation.

To comprehend the profound impact of financial abstraction, it is important to delve into the intricate workings of the human mind. Our perception of money, and consequently our behaviour in financial transactions, is deeply influenced by psychological factors that come into play when the tangible nature of currency is replaced by its digital representation.

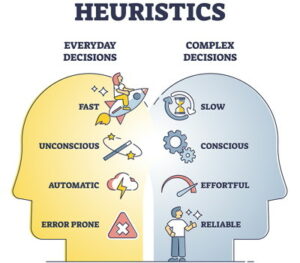

One crucial aspect of this phenomenon is the concept of ‘mental accounting.’ This psychological heuristic suggests that individuals categorise their money into various mental accounts based on its source, purpose or form.

In the realm of financial abstraction, this categorisation becomes more fluid. Without the physical presence of cash, the lines between different accounts blur, potentially leading to a more liberal approach towards spending or wagering.

The distinct boundaries that physical currency imposes on our spending habits are eroded in a world of digital balances. On top of that, studies in behavioural economics have demonstrated the powerful influence of framing effects on decision-making. When money exists in abstracted forms, such as digital balances or virtual tokens, the context in which it is presented can significantly impact our perception of its value.

As an example, a £50 balance in an online betting account may not carry the same weight as a crisp £50 note in hand. This discrepancy in perceived value can lead to riskier behaviour, as the detachment from physical currency diminishes the emotional weight of the transaction.

Another psychological element at play is the phenomenon of temporal discounting. This refers to our tendency to value immediate rewards more highly than future gains. In the realm of financial abstraction, this inclination is often exacerbated. When money is represented digitally, the immediacy of gains and losses is heightened.

This is because our transactions occur in real-time and with the click of a button. The acceleration of financial feedback can lead to impulsive decision-making, as the visceral experience of handing over cash is replaced by the instantaneous gratification of digital transactions.

In addition, research has shown that the use of abstracted currency can contribute to the ‘illusion of money.’ This cognitive bias occurs when individuals perceive digital forms of money as less ‘real’ than physical currency. This illusion can lead to a disconnect between our rational understanding of financial stakes and our emotional response to them.

In addition, research has shown that the use of abstracted currency can contribute to the ‘illusion of money.’ This cognitive bias occurs when individuals perceive digital forms of money as less ‘real’ than physical currency. This illusion can lead to a disconnect between our rational understanding of financial stakes and our emotional response to them.

In other words, the consequences of wins and losses may not carry the same emotional weight when experienced solely in the digital realm. In essence, the psychology of financial abstraction illuminates the intricate interplay between our cognitive processes and the medium through which we engage with money.

As cash gives way to digital representations and virtual currencies, our psychological relationship with money undergoes a huge transformation. Understanding these underlying mechanisms provides a crucial lens through which we can navigate the complexities of financial transactions, especially in the context of gambling.

Cash vs. Digital & The Detachment Dilemma

The transition from tangible cash to digital forms of currency marks a crucial shift in how we engage with money. It is a transformation that extends its reach into the realm of gambling, reshaping the very dynamics of risk and reward.

The transition from tangible cash to digital forms of currency marks a crucial shift in how we engage with money. It is a transformation that extends its reach into the realm of gambling, reshaping the very dynamics of risk and reward.

In comparing the experience of using physical cash to placing bets online or with casino chips, we uncover a detachment dilemma that underscores our evolving relationship with financial transactions. When we handle physical currency, there’s a palpable connection between the money and its value that is important.

The crisp bills, clinking coins and the physical sensation of exchange provide an experience that is inherently linked to the concept of value. When we wager with cash, every bet carries a weight that is both symbolic and literal. The act of parting with money is a conscious decision, one that requires a deliberate choice to assume risk.

In contrast to this, the digital realm introduces a layer of separation. Transactions occur at a remove from the physical world, mediated by screens and interfaces. Clicking buttons or tapping screens to place bets just isn’t the same as handing over real money.

This detachment from the physicality of money can subtly alter our perception of the stakes. The immediacy of digital transactions can blur the line between casual bets and more substantial wagers, potentially leading to riskier behaviour from some.

The absence of physical currency can contribute to what behavioural economists term the ‘money illusion.’ When transactions occur digitally, the actual experience of handing over cash is replaced by the abstraction of numbers on a screen. This can lead to a discrepancy between our rational understanding of the financial stakes and our emotional response to them.

Winning or losing in this digital context may not carry the same emotional weight as it would with physical currency. Casino chips represent a unique facet of this detachment dilemma. These tokens, used extensively in physical gambling establishments, serve as intermediaries between the player and their money.

Chips offer a buffer, a means of putting financial stakes into compartments and creating a layer of cognitive distance. They become placeholders of value, allowing players to engage in the game with a certain level of detachment from actual currency.

In the digital world, this layer of detachment is amplified. Online betting platforms operate in a virtual space, where monetary values exist only on the screen. The absence of physical cash further removes us from the reality of our wagers.

The boundaries between various ‘mental accounts’ of money become more porous, potentially leading to a more liberal approach towards spending or wagering. In navigating this detachment dilemma, it becomes important to consider how the medium of exchange shapes our perception of financial transactions.

The Rise of Crypto & Double Abstraction In Gambling

As the digital landscape continues to evolve, so too does the nature of financial transactions. Nowhere is this more evident than in the proliferation of cryptocurrencies, which is a technological marvel that introduces an additional layer of detachment when spending money.

As the digital landscape continues to evolve, so too does the nature of financial transactions. Nowhere is this more evident than in the proliferation of cryptocurrencies, which is a technological marvel that introduces an additional layer of detachment when spending money.

Cryptocurrencies, decentralised digital currencies secured by cryptography, offer a level of anonymity and security previously unparalleled in traditional financial systems. When used for gambling, they introduce what can be described as a ‘double abstraction’.

We’ve mentioned this already, but it is worth taking a closer look. The first layer of abstraction occurs when you convert traditional currency into a cryptocurrency, entering the realm of purely digital assets.

This initial step detaches the currency from its physical form, rendering it a series of encrypted data points on a blockchain ledger. This virtual representation of value, existing solely in the digital realm, can already create a clear shift in our perception of the stakes. The emotional weight of handling physical cash is entirely absent. However, it is the second layer of abstraction that sets cryptocurrencies apart.

When individuals use cryptocurrencies for gambling, they are engaging in transactions that are entirely detached from any traditional banking system. This means that even the intermediary institutions that typically facilitate transactions, such as banks or eWallets, are bypassed.

The result is a direct peer-to-peer exchange, often facilitated by smart contracts or blockchain-based platforms. This double layer of detachment can have huge implications for our understanding of monetary value and risk. The very nature of cryptocurrencies can imbue transactions with a sense of unreality.

The lack of a physical representation can create a sensation akin to playing with tokens in a digital arcade, further removed from the tangible reality of money. On top of that, the volatility of cryptocurrencies introduces an additional layer of complexity.

The fluctuating value of digital assets can introduce a level of uncertainty that surpasses that of traditional currencies. This can lead to both heightened excitement and increased risk aversion, depending on the individual’s risk tolerance and perception of the cryptocurrency’s stability at the time of placing bets.

Whilst cryptocurrencies offer unparalleled security and privacy in financial transactions, they also introduce a unique set of challenges, particularly in the context of responsible gambling. The absence of traditional oversight and regulation means that individuals are largely responsible for self-policing their gambling behaviour, which is far from ideal.

There is also a possibility in the future for what may be termed triple abstraction. With the rise of virtual reality and the metaverse it is expected in the future you may visit virtual casinos or betting shops using an avatar in a completely virtual reality. If you are playing in a metaverse with casino chips purchased with cryptocurrency then you are a long way from the cash you started with. That could be psychologically potent for many gamblers.

In navigating this double (or potentially triple) abstraction, it is crucial for individuals to approach cryptocurrency gambling with a heightened awareness of the additional layers of detachment involved. Understanding the implications of this shift in medium is vital for making informed decisions and for maintaining a healthy relationship with gambling activities.