There are times when confidence in our own decision making can be important and helpful. It is rarely the case that that is true when it comes to gambling, when being overconfident can lead us to make irrational and poor decisions. Being overconfident in our gambling performance can sometimes lead us feeling as though we know more than others, with the result being that we place poorly thought out wagers.

There are times when confidence in our own decision making can be important and helpful. It is rarely the case that that is true when it comes to gambling, when being overconfident can lead us to make irrational and poor decisions. Being overconfident in our gambling performance can sometimes lead us feeling as though we know more than others, with the result being that we place poorly thought out wagers.

Humans will often naturally overestimate their own capabilities, which is a phenomenon sometimes referred to as the Lake Wobegon effect. The fictional town of Lake Wobegon in Minnesota is one where the women are strong, the men are good-looking and the children are above average. People describing themselves as above average can lead to a cockiness that results in poor betting, which in turn loses the victim money.

Overconfidence Effect Explained

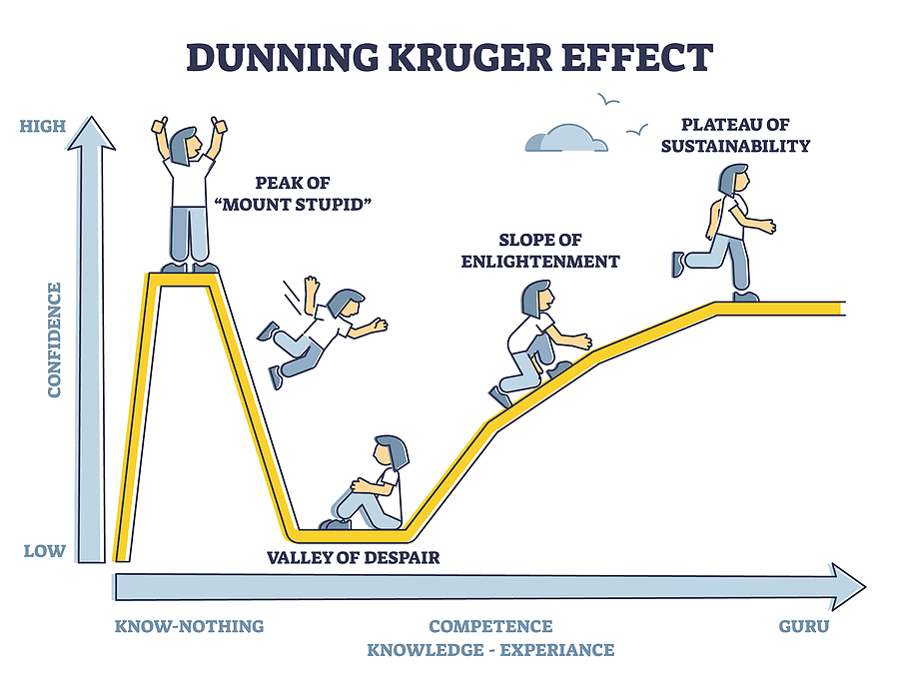

Of all the cognitive biases that affect human beings in their sports betting, the overconfidence bias might be the most influential as well as the most prevalent. Anyone that is convinced their own reasoning, judgement or cognitive ability is likely to fall foul of the overconfidence bias. They will overestimate their own abilities as well as their knowledge of a subject, leading to mistakes when approaching a problem. It is often linked to the hot hand fallacy, where people believe they are ‘on a run’ and are more likely to get things right the next time.

Of all the cognitive biases that affect human beings in their sports betting, the overconfidence bias might be the most influential as well as the most prevalent. Anyone that is convinced their own reasoning, judgement or cognitive ability is likely to fall foul of the overconfidence bias. They will overestimate their own abilities as well as their knowledge of a subject, leading to mistakes when approaching a problem. It is often linked to the hot hand fallacy, where people believe they are ‘on a run’ and are more likely to get things right the next time.

The result of being overconfident is that predictions are made about the future that are unlikely to come true. In essence, the overconfidence effect can be broken down into three different forms, with the first one being an overestimation of the performance you’ll put in in the future. The second is a placement of your own performance that exceeds how you rate the performance of other people, whilst the third is an inability to faithfully reflect on your own accomplishments.

As you might imagine, overconfidence bias is in effect in virtually every part of life. Politicians that constantly make mistakes but continue to act as if they’ve been brilliant in everything they’ve done are one such example. When there’s a gap between what people think they know and what they actually know, the confidence bias will fill in the cracks and allow people to act as if they have all the information they need for decision making.

The Evidence Supporting The Theory

Daniel Kahneman, who is widely considered to be the psychologist who pioneered cognitive biases as a theory, believed that overconfidence is simultaneously the most dangerous of them and the most common. It’s also likely that overconfidence bias is the equivalent of a gateway drug to other biases, such is the extent to which it leads people down a path of believing that they’re right in making other incorrect decisions.

Psychologists have demonstrated overconfidence in numerous ways, with the most simplistic being asking people how confident they are about something and comparing it with the confidence, or lack thereof, of their peers over the same issue. It goes without saying that human confidence is not the perfect predictor of the future, given that people with 100% confidence in their own beliefs are never correct 100% of the time.

When psychologists spoke to students, they discovered that those believing themselves to be ’99 sure’ about an answer were incorrect as much as 40% of the time. More than 50% of business owners believed that they ran their business more ethical than 90% of their rivals, whilst more than 93% of American drivers believed that they were better than average as a driver.

Investors making errors in the stock market usually do so because of overconfidence, with excessive trading being a key factor. Indeed, some psychologists believe that overconfidence was a big part of the reason for high-profile failures such as the Columbia space shuttle disaster, the Deepwater Horizon oil spill and even the catastrophe at Chernobyl. The desire to act ‘certain’ often stops people from admitting their lack of knowledge.

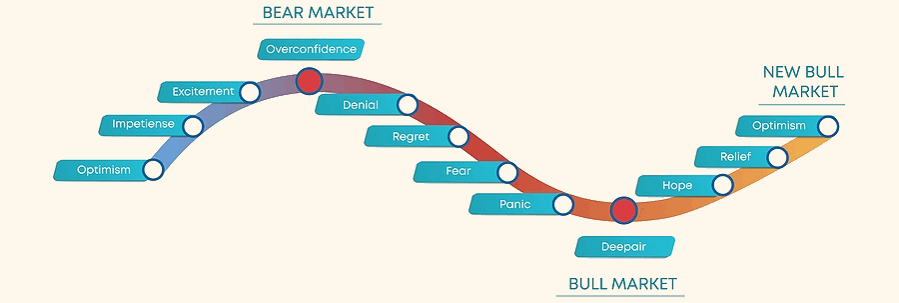

Think Of The Stock Market

When someone sells a stock, someone else inevitably has to buy it. What does the seller know that the buyer doesn’t? Alternatively, what does the buyer know that the seller doesn’t? Someone in the transaction must be making a mistake of some sort. One of the people involved in the transaction must, by definition, be more wrong than the other. No sales happen at their ‘true’ value, given that someone is always making a profit.

The fact that both parties involved are happy to engage in the sale and purchase, someone must be demonstrating an overconfidence in their decision making. When they look back on the decision in the future, will both people give an honest assessment of their decision making skills? Or will they ignore the failure and head into their next sale with the same sense of overconfidence as the previous one?

Catching Overconfidence

At the 16th annual SPSP convention at Long Beach, California, the University of California’s Joey Cheng suggested that overconfidence might well be something that you can effectively ‘catch’. Being around someone that is overconfident can lead to other people becoming overconfident themselves. Julia Minson of Harvard explained that ‘two heads are better than one’ might not actually always be true.

At the 16th annual SPSP convention at Long Beach, California, the University of California’s Joey Cheng suggested that overconfidence might well be something that you can effectively ‘catch’. Being around someone that is overconfident can lead to other people becoming overconfident themselves. Julia Minson of Harvard explained that ‘two heads are better than one’ might not actually always be true.

Minson’s research discovered that people are likely to think that their ideas are slightly better than the ideas of other people, thereby rating them with more confidence than they would if they were only asked for their own notion. This is why it’s not necessarily all that sensible to seek advice about the bet that you’re placing, given that it might lead you to placing a wager that you wouldn’t otherwise think of placing.

It’s possible, according to William von Hippel of the University of Queensland, that we try to impress other people and the possible benefit of doing so outweighs the risk associated. This is why it’s not necessarily useful to let other people know what bets you’re considering placing, instead merely getting on with your wagers after doing the associated research to ensure that they’re sensible and well thought-out bets.

Overconfidence In Relation To Sports Betting

We’ve all been confident about our predictions over one thing or another in our lives, even if we’ve later been proven to be incorrect. The question is, how does such a thing relate to sports betting? Ask anyone else you know that bets what they think of their own successes and it’s highly likely that most people will say that they’re above-average. It’s why so many people offer their tips on betting on social media and sites like Reddit.

We’ve all been confident about our predictions over one thing or another in our lives, even if we’ve later been proven to be incorrect. The question is, how does such a thing relate to sports betting? Ask anyone else you know that bets what they think of their own successes and it’s highly likely that most people will say that they’re above-average. It’s why so many people offer their tips on betting on social media and sites like Reddit.

People that are overconfident with their sports bets can find themselves doing things that will ultimately lead to failure. A bet placed with an underestimation of the risk involved can be a dangerous thing. A lack of sober and sensible consideration of your betting is not likely to lead to long-term success. Yes, risk is always involved in placing bets, but not appreciating such risk because of overconfidence can lead to money down the drain.

Sports betting is a long-term game, especially in terms of the success that you’re hoping to achieve. You need to be realistic about your Return On Investment, ensuring that overconfidence doesn’t lead to a clouding of judgement with the bets that you’re placing. Even brilliantly successful bettors are lucky to hit a 60% ROI, so accept that you’re unlikely to do so and don’t berate yourself for ‘underachieving’.

One of the chief issues of overconfidence in betting comes in the form of placing the same sort of bet over and over again because it’s been a winner a few times. Mixing things up is a crucial part of a sensible betting strategy, but not all punters do this because they’re so confident that they’ve found a ‘winning formula’ in the form of placing the same sort of bet each time they decide to place a wager.

Though not sports betting as such, a study asked people to choose between winning $5,000 with a 0.001% probability of doing so or winning $5 with certainty. 72% of people opted for the chance of winning $5,000. That might be more to do with the fact that definitely winning $5 will make less of a difference to their lives than possibly winning $5,000, but it also indicates how some people will feel more confident than others when it comes to money. After all, millions of people regularly play the lottery.

Overconfidence In Tipsters

Commonly in betting people pay attention to tips, even if they cannot verify the source of those tips. This is, in effect, overconfidence in the tipster and can lead to people losing money simply because they trust that the person tipping must know more than them.

Commonly in betting people pay attention to tips, even if they cannot verify the source of those tips. This is, in effect, overconfidence in the tipster and can lead to people losing money simply because they trust that the person tipping must know more than them.

Even most genuine tipsters online would not break even and most tipping sites earn money through advertising. You have to ask yourself if someone was so good at betting why that in itself would not be enough of a living?

This overconfidence is also exploited by nefarious tipsters. For example, SMS tips have become common for horse racing. Basically the tipster tips every horse, or every horse that has a chance of winning, in a given race and sends different selections to different people. This means that some of those ‘tips’ will definitely win, giving the impression to the punter that this is a good tipping service to sign up to. When in reality it is a con.

Experts Suffer Overconfidence The Most

Nassim Taleb’s incredible work on risk and probability, The Black Swan: The Impact of the Highly Improbable, revealed that people that considered themselves to be experts were more likely to fall foul of overconfidence than ‘normal’ people. During his studies, he asked a group of economists and a group of zookeepers to predict the price of oil five years down the line. Both groups were equally inaccurate, but the economists were more certain that they would be proven correct.

Nassim Taleb’s incredible work on risk and probability, The Black Swan: The Impact of the Highly Improbable, revealed that people that considered themselves to be experts were more likely to fall foul of overconfidence than ‘normal’ people. During his studies, he asked a group of economists and a group of zookeepers to predict the price of oil five years down the line. Both groups were equally inaccurate, but the economists were more certain that they would be proven correct.

The rule of thumb on this is that someone being declared as an ‘expert’ doesn’t mean that they’re less likely to suffer from overconfidence. Imagine a former sports person talking about the sport that they used to be involved in and doing so up against, say, a musician. The sports person is likely to be far more certain that they know what they’re talking about than the musician, but in actual fact both of their predictions will likely be about as right as each other.

Problem Gamblers Suffer Overconfidence

Studies by the South Oaks Gambling Screen in America revealed that problem gamblers were more likely to fall foul of overconfidence with their bets than those that had their gambling under control. The study found that people that were pathological or problem gamblers placed systematically less favourable bets than their counterparts, displaying overconfidence in the decisions that they made.

Studies by the South Oaks Gambling Screen in America revealed that problem gamblers were more likely to fall foul of overconfidence with their bets than those that had their gambling under control. The study found that people that were pathological or problem gamblers placed systematically less favourable bets than their counterparts, displaying overconfidence in the decisions that they made.

The study came to the conclusion that problem gamblers were less affected by control than their peers, but the slope of their betting function was more affected. Pathological and problem gamblers tend to process information about their confidence in betting as well as the control that they have differently from non-problem gamblers. It is something worth noting if you think you might have a problem or are generally overconfident.

How Do You Avoid Overconfidence?

Having a healthy degree of scepticism about your own betting ability is the best place to start when it comes to defeating the issue of overconfidence. You should question each bet that you make, looking at it from numerous different angles and weighing up all of the various likely outcomes. Try to think about your bets dispassionately and ask yourself if you’re being overconfident in the predictions that you’ve made.

When you’re thinking about placing a bet, there will be one part of your brain that is convinced that it’s the right one to place whilst the other part will be more realistic in its approach. Psychologists believe that finding the ‘Goldilocks zone’ in between these two approaches is what you need to do to be successful. The key is to look at all of the available evidence before placing a bet, rather than just doing it blindly.

There will always be some bets that are worth placing more than others. Being able to stop yourself from ignoring the evidence before placing a bet is key to avoiding the pitfalls of overconfidence. Does the bet that you’re thinking of placing tally with the information that you have available to you about the wager’s likely outcome? Are you placing a bet based on a whim more than on the actual evidence to hand?

It is a difficult thing to do, largely because you neither want to be overconfident nor do you want to be questioning your every move. This is why it’s important to be honest about your successes and failures, rather than ignoring your failures and allowing your successes to trick you into thinking that you’re brilliant and win every bet you place. All bettors have a limit on both their bankroll and their own knowledge of the subject, so knowing your limit is key.