We live in a data driven world.

We live in a data driven world.

Almost anything you can think of has reams of digital records that can explain the past and inform the future; sports results, used car prices, the number of baguettes sold in Manchester – someone, somewhere is keeping tabs on it all.

This data is kept in excel sheets on huge computers, which can be opened up to study trends and examine performance, understand failing businesses, and gauge the changing opinion of the public.

The gambling industry is no different, and as the regulating body of the industry, the UK Gambling Commission have been collecting data on where we bet, what we bet on, and how we like to bet on it since its’ creation.

Now, the UKGC was only formed in 2007, so the data they have collected only goes back to 2008. Even then, the data they collected in the early days wasn’t particularly deep, although it has improved over the years, so some of the more granular information such as exactly what sports people are betting on only dates back to 2016.

Nevertheless, this goldmine of statistical information regarding the behaviour of gamblers in the UK can tell us an awful lot about long-term and short-term trends, changing tastes, and even paint a picture of the economic situation in the country over the years.

We can see online (remote) revenues increase while high street (non-remote) revenues drop off; we can see huge increases in the Gross Gambling Yield (GGY) as the world starts to rely more and more on the internet, and as UK tax laws change; and we can understand what gamblers want when they log on compared to when they visit a casino or bookmaker, by studying how they spend their money when they are there.

This gives us great insight into the industry as a whole, and also allows us to see the impact that world events are having on gamblers and the gambling industry.

I know that my gambling tastes have changed over time, although I wasn’t always paying much attention to why. Well it seems I was far from alone, and this data from the UKGC has been incredibly informative in gaining a better understanding.

Main Summary of Latest UKGC Stats

If you want the TL;DR (too long; didn’t read) version of this article, then this is it, followed by a brief explanation of Gross Gambling Yield.

The UKGC data shows an awful lot that you could dig into, but I would say that the main takeaways are:

- People are increasingly moving towards online gambling and away from the high street. Online bookie revenues are up 192% since 2008, while high street bookie revenues are down 15% in the same period; online bingo revenues are up a huge 36,844% since 2008, while bingo club revenues are down 16%; and online casino revenues are up 12,106% since 2008 while high street casino revenues are up just 1.7% from 2008 to 2023.

- The number of gambling premises (covering bookies, casinos, arcades, bingo halls, etc) in the UK is down 32% from a high of 12,307 in 2011. That number is now 8,301, lower than it has been since the UKGC started keeping records in 2008.

- Although the industry has largely recovered from covid in terms of overall GGY – it’s actually 6.59% higher than pre-covid levels as of 2023 – the cost-of-living crisis has slowed down growth. What’s more, while online gambling benefitted from the lockdowns their revenues have largely fallen back from those 2020 highs, and some high street gambling businesses are yet to recover; casinos are still more than 20% behind pre-covid levels, bookies revenues have grown just 2.5%, and bingo halls have grown similarly slowly at 2.6%.

- Gamblers are more and more attracted to big win potential regardless of the odds, over more balanced games and gambling types. The trend towards slots and lotteries is obvious, while the amount of revenue taken from games of skill or traditional betting is either falling, or not growing at anywhere near the same sort of pace.

There is much more to read into these figures though, they don’t tell a complete story on their own, but they can give you a solid overview of the gambling industry and how it has been changing over time.

What is Gross Gambling Yield (GGY)?

This is going to be mentioned a lot, so let’s make sure we all understand it.

This is going to be mentioned a lot, so let’s make sure we all understand it.

Gross gambling yield, or GGY, is the total amount taken by the gambling industry as a whole once all winnings have been paid out. You can think of it as sales revenue if that makes it easier.

To put this into context, the turnover for the gambling industry in 2006/07 was something like £84 billion – that’s how much money was put through bookies, casino, lotteries etc in the financial year.

However, a huge proportion of that went back out to winning players and punters, and what was left, was the GGY, which was about £9.3 billion in this instance.

Operators still need to pay their costs and taxes out of this remaining money so it’s not the same as net profit.

Individual companies will have their own GGY pertaining to their own business operations, but to get the GGY of the industry, the UKGC adds the GGY of all individual companies together.

These are any and all licensed gambling operators in the United Kingdom, so bookmakers, casinos, bingo halls, arcades and adult gaming centres, the National Lottery and other lotteries, everything. That’s online and offline versions of all of these businesses too.

Gross Gambling Yield is a useful metric by which to look at the overall health of the gambling industry, but it is a very broad figure, and does not give any real insight to what is happening underneath the service.

The GGY could improve even if turnover does not, because companies have found more ways to reduce costs and increase profit, for example. Equally, GGY could be going great guns, but while online gambling is sky rocketing there could be a high street betting shop crisis going on.

Major Gambling Trends over Time

By zooming out and taking a wider view of the information that is available, we can start to see long term trends in all sort of areas of the gambling industry.

Small changes each year in a certain area can get lost when the focus is on more recent times, but by taking a step back it’s possible to see how these small continuous changes compound over time to create what is actually a huge shift in customer behaviour, for example, or operator behaviour for that matter.

Some of the major trends are explored below, but if you are interested in a specific sector of the gambling industry, I have dedicated posts on each of them which you can find links to below.

Latest Sports Betting Industry Statistics

The sports betting sector is one of the strongest pillars of the gambling industry, and arguably the most interesting from data point of view too, since it has so much depth.

We can talk about a multitude of different sports and their changing popularity with bettors, as well as a few different ways to bet, and we can investigate this both in the online world and in the physical world of high street betting shops.

Looking at the stats, punters clearly have their favourite sports they like to bet on, but those tier 2 sports tend to go up and down in popularity, and on the whole, it seems like bettors are becoming less adventurous than they used to be.

Latest Bingo Industry Statistics

Poor old bingo has had some rough times in the last few decades, and although online bingo is proving more popular every year, the pace of acceleration doesn't match the pace of the drop in revenues from high street bingo halls.

That said, bingo is one of the only sectors of the gambling industry where the majority of money is still made on the high street, which tells you a lot about what sort of people play bingo and why. It really is a social game played by people who want company.

The UKGC data also details the sorts of gaming machines present in bingo halls, how many of each type there are, and how this has changed over the years. Something else we can glean useful insights from.

Latest Lottery Industry Statistics

Some people don't actually realise that the National Lottery (and other lotteries) are gambling, but not only are they most definitely gambling, but lotteries make up almost a third of the total GGY for the whole gambling industry.

There are probably more smaller lotteries running in the UK than most people realise, and their GGY is on the up where the National Lottery is stuck in a bit of a rut, and this is a long term trend too.

This could have something to do with how much easier it is to start a lottery now, thanks to an increase in external lottery managers who are taking more and more of the load from the organisations lotteries are being run on behalf of.

Latest Arcade Industry Statistics

The Arcade sector is an unsung hero of the gambling industry, and although it only adds millions rather than billions to the industry wide gross gambling yield, it tends to improve year on year where other land based gambling businesses are flagging.

The regulations around the type and number of machines permitted inside different venues is complex to say the least, but the UKGC data shows a clear increase in one type of machine in particular, where others barely feature at all.

The types of machines found in arcades have actually decreased in number overall, and the industry hasn't yet recovered from covid, but historically it holds up very well compared to other struggling gambling venues.

Latest Casino & Slots Industry Statistics

The casino industry is worth multiple billions to the overall GGY of the gambling industry, and although the online sector is responsible for the majority of that the number of high street casinos in the UK remains relatively stable.

Like many land based businesses, the high street casino side of things has taken a huge blow of late, both as a result of covid and the cost of living crisis, but online things are still booming, in fact, there is more money coming in online than ever before.

The types of games that people are playing are becoming less diverse though, with more and more money coming from slots as revenue from less popular game types seems to be on the decline.

Now, onto the major trends.

The Decline of High Street Gambling

Probably rather unsurprisingly, the biggest trend over time is the shift from non-remote to remote gambling.

Probably rather unsurprisingly, the biggest trend over time is the shift from non-remote to remote gambling.

In layman’s terms, this means people are spending more money online and less money on the high street.

This is a trend that has been ongoing since internet gambling came into existence, first as a little trusted fad, and quickly turning into the gambling method of choice for many.

If we go back to 2016 and look at online sports betting revenue for example, it stood at £1.74 billion. This number increased year on year (apart from a dip in 2018), reaching a total of £2.28 billion in 2023 – an increase of 31% over 6 years.

Online bingo has had a similar journey, starting off at £122 million GGY in 2016 and rising each year to reach £174 million in 2023 – an increase of 42.6%.

It is online casino that has seen the most dramatic rise though; it boasts a staggering 70.8% increase from £2.36 billion in 2016 to £4.03 billion in 2023.

During this same period, the number of high street betting shops dropped from 8,915 to 5,995, a 32.75% drop); we have lost 8 high street casinos dropping from 152 to 144, representing a 5% reduction; and we have gone from 654 to 650 bingo halls, which is around a 0.6% reduction.

However, these numbers alone don’t represent the full picture, because although the number of venues closing their doors doesn’t look too bad in the casino and bingo sectors, the amount of money the venues are taking is worrying:

| Sector | 2016 GGY | 2023 GGY | Reduction |

|---|---|---|---|

| Bookmakers | £3.318 | £2.475 | -25.4% |

| Casinos | £1.164 | £810 | -30.4% |

| Bingo Halls | £693 | £592 | -14.6% |

Obviously, lower revenues like this over a sustained period will mean more venue closures as the businesses try to reduce costs or fold completely, at which point those gambling venue numbers will drop like a stone.

So what is causing this downward trend?

Well, the covid outbreak changed things in a big way for the non-remote gambling businesses, but even before that things were shifting.

Bookies shops had it hardest, since they rely on passing trade more than a casino or a bingo hall; you probably wouldn’t head into town especially to make a bet, you’d do it on the way to the pub, or on your lunch break, but a bingo or casino session is a longer form activity and more of an event in and of itself.

As people increasingly work and socialise at home and do their shopping online, betting shops have fewer customers passing them by. In fact, the only reason the numbers for betting shops aren’t worse, is because they began to introduce more gaming machines and for a good 5 yeas were earning significantly more from those than they were from people making sports bets.

Bingo halls were on a slow decline too, but the gradient was not steep (until covid), probably more due to an ageing customer base than anything else, and high street casinos were holding their own too since people tend to use them as a fun night out and a reason to leave the house, although their annual revenues were choppier.

It is clear though, that as the GGY of the entire industry was rising, the GGY of online sectors was rising with it, while the GGY of in person non-remote sectors was either stagnant, or falling.

The National Lottery Keeps More and Gives Less

People don’t tend to think of the National Lottery in the same way as other gambling products, but make no mistake about it – gambling it is.

People don’t tend to think of the National Lottery in the same way as other gambling products, but make no mistake about it – gambling it is.

The National Lottery isn’t the only lottery that is available in this country, far from it, but it is the biggest by a country mile.

The whole point is that a large amount of the money taken each week goes towards charities and good causes, while a huge chunk is also given out as prize money, and smaller amounts go to retailers in commissions and to the licensee themselves, who up until February 2024, was Camelot. The percentage that goes to each area is pre-set.

What we see from the UKGC data though, is an increase in GGY from the National Lottery, and an increase in the amount kept by the license holder, but the amount being given to good causes in 2023 is actually lower than it was in 2012/13.

Yet, the total sales have been steadily trending upwards in recent years, after recovering from Camelot’s decision to double the ticket cost in 2017 – that saw a drop in revenue of 9% and it took 3 years to get back to 2017 revenue levels.

Despite National Lottery revenues being split up in structured way, the licensee has room for manoeuvre within their annual accounting just as any other company does, and the data shows things moving in opposite directions.

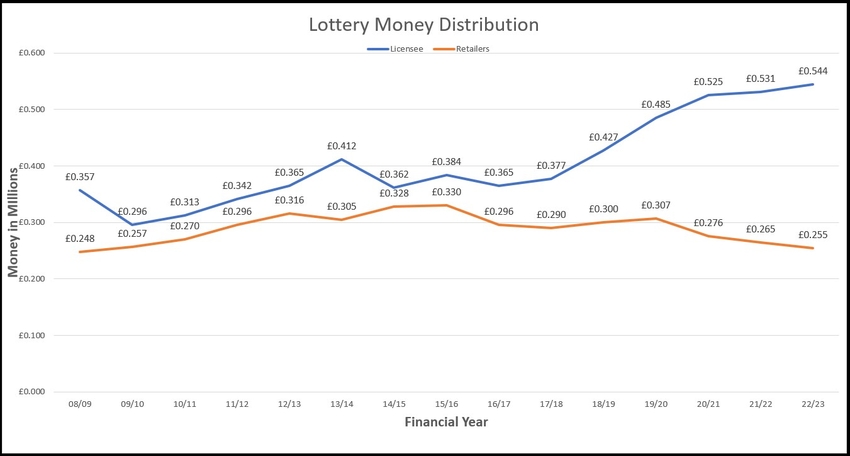

First, look at this chart:

As the licensee retains more and more, the retailers are getting less and less, and yes, this could be partly down to more and more people buying direct online from the National Lottery website or app, but the widening gap seems to suggest more than this alone.

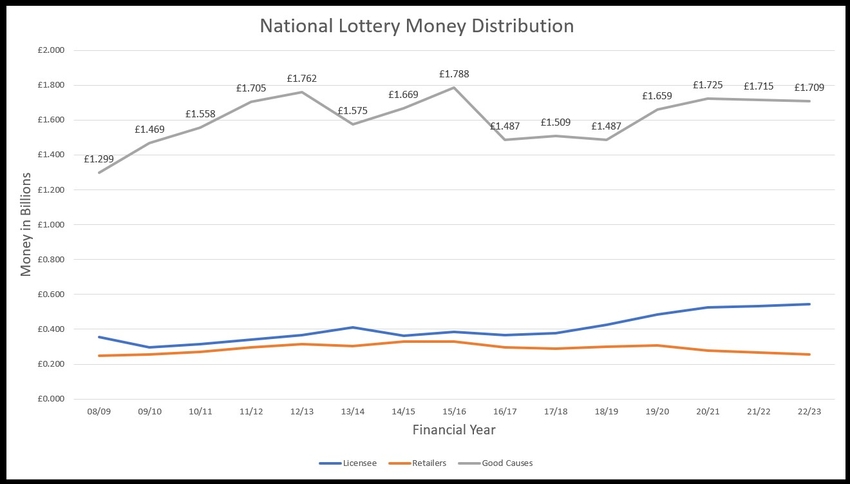

Now look at this chart which shows the same information but also includes contributions to good causes:

True, the difference in amounts is tremendous, with good causes getting billions rather than millions, but when you consider the revenue from the National Lottery has been steadily increasing each year, topping £8 billion in recent years, shouldn’t it be higher?

Good causes contributions should be steadily increasing at the same rate as revenues, but instead, they remain pretty flat. In fact, in 2023 good causes received 4.4% less than they did in 2015/16, despite the revenue being 7.4% higher.

Yet, Camelot, the licensee, is keeping 41.6% more in 2023 than they were in 2016.

This doesn’t account for inflation either, which has cumulatively gone up around 34% since 2016, so that £1.709 billion given to good causes in 2023 is worth around 34% less than it would have been in 2016, when they actually got a higher figure too.

Camelot have been taken to task about this and indeed, it may be one of the reasons they lost the lottery license, but claimed they needed to spend more on prizes and advertising to keep people playing.

Other lottery products are not showing the same disparity though, with their contributions to good causes improving year on year in line with growing revenues, hovering around the 45% mark.

They can justify it however they like, but the bottom line here, is that Camelot have been keeping more, while good causes (and retailers) have been getting less.

Gamblers Becoming More Interested in Big Wins at Long Odds

It seems from the data, that people’s mindset around gambling is changing.

It seems from the data, that people’s mindset around gambling is changing.

More money is being spent on million to one longshot products and less is being spent on gambling that requires any level of skill, or any sort of time investment.

On the whole, it seems that people would rather chuck a tenner at lottery tickets or into a slot that might pay out a big jackpot, than spend that money on an evening at bingo, or on a few well researched bets on the horses, or at the blackjack table.

The huge spike in online casino revenues after the 2014 tax law change continued on an upwards trend until even today, up 12,106% as of 2023 (that’s not a typo), and we also know from the data that players who use online casinos increasingly spend on slots rather than other types of casino games.

In 2008 slots accounted for 65% of the online casino industry’s GGY, but as of 2022 that has gone up to 79.8% – just over £3.2 billion pounds.

The online slot playing community have been complaining for some time now that the maths models in newer slots are much less fun to play, because again, developers are favouring once in a blue moon big win potential over smaller more frequent payouts. There are more slots coming out at sub-96% RTPs too.

This would help to explain to growth in GGY for online casinos and specifically slots, but the level of growth is too significant for this alone to be the reason.

Player tastes are changing.

Sales of lottery products have been going up too, with the National Lottery seeing a 59% increase since 2008 and other lotteries a stonking 427% increase in the same period.

Maybe people are turning to these cheaper alternative lotteries because they think they stand a better chance of winning them what with there being less competition, but there are also a lot more of them these days than there used to be.

The Health Lottery and the Postcode Lottery are arguably the two next biggest after the National Lottery, but most charities run lotteries these days too and they all need a license from the UKGC to do so.

None of this accounts for products like the Omaze draw and Best of the Best either, which appeal to a different part of our brains by offering cars and houses as prizes rather than simply cash. They are competitions and prize draws rather than lotteries, so their revenues are not included in the data, but their growing popularity helps to emphasize the point here.

This all tells us that people are increasingly turning to those instant wins, or those ‘cross your fingers and hope all your problems will be solved’ type products.

Of course, this isn’t to say there is no one left who likes competing against the bookies – online betting GGY has been going up too, about 31.1% since 2014, and on course betting revenues had barely changed for over a decade until covid came along – but the balance is certainly shifting.

What I see from this, is gamblers going for glory rather than slow and steady returns. The thought process being, “I’ll probably lose anyway, so I may as well spend my money on whatever could win me the most if I get lucky.”

Take into account too, that people tend to make more reckless decisions when they have less to lose, so if everyone has less money to spend they are more likely to go for broke than make measured strategic gambling decisions.

Short Term Trends of FOBTs and The Changing Nature of Betting Shops

A really eye-opening takeaway from the UKGC data can be found when looking at how betting shops have made their money over the years.

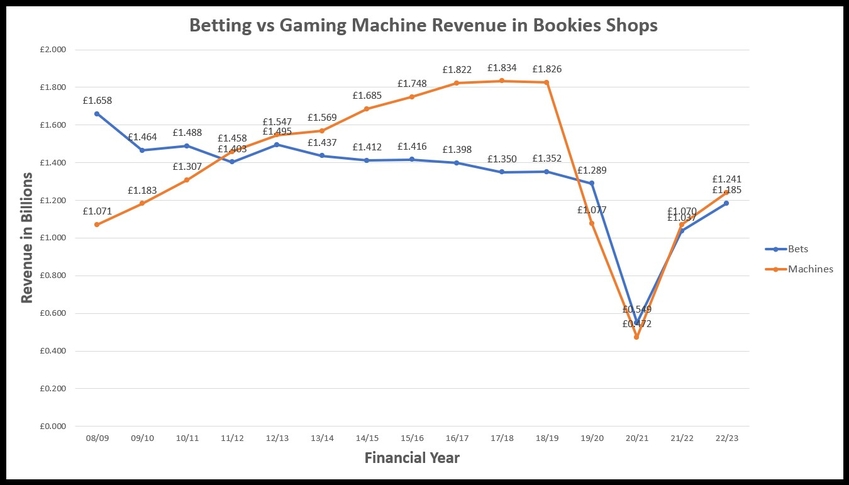

The graph above shows the changing nature of what betting shops were being used for.

Back in the day, a bookie was known as a licensed betting office and the interiors fitted this description well. They were much more office like, with a few places to write out your betslips, maybe some racing info on the walls, and a glass fronted counter behind which a man in shirt and trousers would take your bets. You would even find frilly net curtains in the windows.

Anyway, over time bookies changed and became more laid-back places; different products were introduced to the shops and these included gaming machines such as Fixed Odds Betting Terminals (or FOBTs).

They started out as a little side earner, but customers began to spend more and more on FOBTs and the like until a crossover occurred in 2011/12, when the bookies actually started making more money from these machines than from people placing bets.

So taking bets was no longer the main purpose of a bookmaker’s shop.

A number of things could be behind this, but one is our increasing need for immediacy that social media and the internet has created.

A number of things could be behind this, but one is our increasing need for immediacy that social media and the internet has created.

We have shorter attention spans, we want answers, products, and results immediately, and we are less inclined to put effort in if there is an easier alternative available. Well, making bets requires a bit of research and some thought, playing an FOBT does not.

Bookies shops had started to become social hubs around this time too, with comfier seating, snacks and drinks, customer toilets, endless sport shown and multiple televisions. Customers could hang out there and, even if they were betting, might throw a few quid on the machines while waiting for their race, for example.

Many people were saying that high street bookies would not survive were it not for the FOBTs, so when the government stepped in to limit their maximum stakes to £2 after much campaigning from anti-gambling groups, bookmakers were obviously worried.

In 2018/19, betting shops were making 35% more from FOBTs than from bets on sports; after the £2 maximum stake laws were introduced the next year, FOBTs were responsible for around 20% less revenue than sports bets, and betting revenue had declined from £1.352 billion the previous year, to £1.289 billion, so while the impact is obvious on the chart, it was even more significant than it at first appears.

This wasn’t because fewer people were using FOBTs, but because they couldn’t spend the same sort of money on them as before.

As of 2023, the revenues from bets and gaming machines are about level, but revenues for both are still lower than they were way back in 2008.

Timeline of Influential Events

All sorts of things can impact the fortunes of the gambling industry from year to year. A World Cup can see a flurry of extra betting activity in the football markets, for instance, a change in the law around certain gambling products can cause dips in certain areas, but most of these time these things are swallowed up and absorbed by the rest of the industry.

Sometimes though, something happens that is so far reaching and impactful that the whole industry is either disrupted by it, or changed forever.

These are some of the most influential events that have altered the direction of the gambling industry in recent times.

Financial Crash: Dec 2007 – June 2009

Although the data starts here, the 2008 financial crash was a significant global event which heavily impacted the industry.

Although the data starts here, the 2008 financial crash was a significant global event which heavily impacted the industry.

Stock markets around the world collapsed, the housing industry went berserk with prices dropping as much as 20% at the worst point, and the UK entered a recession along with many other countries.

As you can imagine, in those cash strapped times gambling was not exactly top of the list of things to spend money on.

From an estimated GGY of £9.9 billion in the 2006/07 financial year, the industry was down to £8.3 billion in the 2008/09 financial year – that’s £1.6 billion less two years later. Revenues are supposed to increase year on year in a healthy economy, so to be down 16.1% over two years is significant.

The gross gambling yield actually reduced even more the following year, to £8.1 billion in 2009/10, as the country was still trying to recover.

Recession was officially declared over in June of 2009, but the gambling industry was clearly still catching up, finally beginning to climb again in the 2010/11 financial year, but only to £8.4 billion.

It wasn’t until 2012/13 that the GGY surpassed that 2006/07 high of £9.3 billion, but even then it was only a little better at £9.7 billion.

The 2013/14 financial year stayed around the same level, before things finally took off again in 2014/15.

The financial crash and the recession that followed put the gambling industry into reverse for 5 years, plus another 2 while the ship was put back on course before it was full steam ahead again.

That’s a 7-year impact.

Gambling Tax Law Change: 2014

Way back in the late 1990s, Victor Chandler of BetVictor fame decided to relocate his business offshore as a way to pay less tax, since the rates in the UK were creeping up so high it was becoming difficult to justify continuing to trade.

Way back in the late 1990s, Victor Chandler of BetVictor fame decided to relocate his business offshore as a way to pay less tax, since the rates in the UK were creeping up so high it was becoming difficult to justify continuing to trade.

This triggered a sort of Pied Piper situation, as many other big gambling companies followed suit, leaving the British Government with a bit of a problem, because they were losing billions in taxes.

You couldn’t blame the gambling companies though; they would be charged around 1% tax for their online operations in places like Gibraltar, even if their websites were available in the UK, whereas the UK rate was 15% of gross profits.

The solution, dreamed up by then Chancellor of the Exchequer, George Osborne, was a point of consumption tax rather than a point of supply.

This meant that any online gambling business that wanted to trade in the UK, would have to pay UK tax on the profits they made from UK residents.

Now, gambling companies would have to pay tax in the UK even if they were an online only business, as a condition of their gambling license. Trading without a license was illegal and would not only put a company at risk of prosecution, but also greatly diminish the number of customers willing to deposit money with them.

The UK is one of the biggest gambling markets in the world, so everyone wanted a slice of it, meaning they all played ball.

As a result, many more gambling operators were brought under the UK’s regulatory umbrella, creating more transparency and increasing GGY simply because more companies were having to pay tax.

This was at the same time that mobile apps were becoming common, making access to gambling easier and quicker, and also created more competition between companies trying to attract customers with advertising and promotions.

The end result was a huge boom in gambling revenues, jumping 36.7% from £9.8 billion to £13.4 billion in just 2 years after the tax changes.

This is where the GGY has stayed since, thanks to other economic impacts holding the industry back, but it would never have got there so quickly without the introduction of the point of consumption tax.

COVID Pandemic: 2020/21

The COVID pandemic of 2020 and the two lockdowns that followed were a terrible time for the UK and the rest of the world too, but the impact on the gambling industry was interesting.

The COVID pandemic of 2020 and the two lockdowns that followed were a terrible time for the UK and the rest of the world too, but the impact on the gambling industry was interesting.

Although most people were not allowed to go to work and many industries shut down completely, there was a lot of financial help put in place by the government to stop the country collapsing.

This wasn’t true for everyone of course, there were people who fell through the cracks and suffered tremendously, but a large proportion of the British public weren’t all that worse off financially.

This meant they had a whole lot of extra time, and still had plenty of money to spend.

What’s more, they were confined to their homes for long periods and even when they did leave, all leisure businesses were closed.

So obviously, people turned to the internet for entertainment, so online casinos and bookies felt the benefit.

While their high street counterparts suffered enormously, online gambling revenue was actually going up.

Online casinos could carry on as normal – even the live casinos weren’t too badly effected – and despite many sports being put on hold due to lockdown, there were some still running, and punters ended up exploring new markets as well as virtuals.

The overall industry GGY had been pretty stable at just over £14 billion since 2017/18, but due to the pandemic it crashed to £12.6 billion in 2020/21. The recovery was quick, but the shock hit to revenue was there nonetheless.

You might say this was a positive result compared with the damage felt by other industries, although if it wasn’t for online gambling the numbers would have been much much worse.

The individual change in revenues/GGY from each non-remote sector of the industry due to COVID are as follows:

| Sector | 19/20 GGY | 20/21 GGY | % Drop |

|---|---|---|---|

| Bookmakers | £2.415 | £1.035 | -57% |

| Casinos | £1.018 | £0.116 | -88% |

| Bingo Halls | £0.576 | £0.246 | -57% |

| Arcades | £0.430 | £0.258 | -40% |

This compounded an already difficult situation where high street businesses were already increasingly losing trade to online businesses.

On the flip side of this, online revenues were doing very well indeed:

| Sector | 19/20 GGY | 20/21 GGY | % Increase |

|---|---|---|---|

| Online Bookmakers | £2.326 | £2.644 | 13% |

| Online Casinos | £3.232 | £4.039 | 25% |

| Online Bingo | £0.177 | £0.189 | 7% |

| National Lottery | £3.399 | £3.531 | 4% |

Online casinos clearly felt the most benefit, while sportsbooks achieved their 13% boost in revenues despite most of the world’s sports being shut down for a time, and National Lottery players were still able to buy their tickets at supermarkets and corner shops, as well as online.

In all cases, the numbers came back to normal levels the year after, although online bingo seemed to be able to maintain it’s increase in popularity more convincingly; while recovery for non-remote business was much slower, with not a single sector back to its’ pre-covid GGY levels even two years later in 2022.

The damage COVID did to high street gambling business was immense and long lasting.

Cost of Living Crisis: 2021 – 2023

Following on from the pandemic, a combination of lockdown damage, Brexit, the war in Ukraine, and sudden inflation created a cost of living crisis.

Following on from the pandemic, a combination of lockdown damage, Brexit, the war in Ukraine, and sudden inflation created a cost of living crisis.

No one can agree on when exactly this started, but late 2021 seems to be the most widely accepted time period.

As free borrowing came to an end and the housing market slowed to a crawl, mortgage and rent payments began to sky rocket at the same time energy increased over 100%, fuel prices hit all time highs of almost £2 per litre, and groceries became more expensive too.

People were hit from all angles, and in times of hardship, luxuries have to go. Gambling is most certainly an unnecessary spend, and so the GGY stalled.

By the end of 2022, the industry wide gambling yield was still a shade lower than it had been pre-covid, despite having had time to recover.

A large part of this is to do with the reluctance for bettors and players to return to in person venues; it seems like many people got out of the routine, and either replaced their in person gambling with online gambling, or just stopped altogether.