When you talk about betting, taking fixed odds on sports is what the average member of the public will think of.

When you talk about betting, taking fixed odds on sports is what the average member of the public will think of.

They would be partially right, but of course there are other ways to make a sports bet and various places to do so, and the way in which punters are choosing to go about their betting business is changing.

We know from the main article that people are choosing to wager over the internet more and more, to the detriment of physical locations like betting shops, but it is the more niche establishments that are really suffering – the dog tracks and the racecourses.

There also seems to be a trend for keeping things simple, as the average punter’s mind is already overloaded with every day life stuff like work, family, bills, etc; I was surprised to see from the data how much pool betting and exchange betting are on the decline.

Betting tastes have remained fairly consistent at the thick end of the wedge, with favourites like football and horse racing easily retaining their place as the top sports to bet on, but amongst the more second tier sports like tennis, golf, cricket etc, there has been more of a shift.

The UKGC data on sports betting, both remote and non-remote, is dense, so there is a lot to be found by looking into it, and it paints an interesting picture of how the average punter is choosing to make their bets and spend their money.

Online vs Offline Sports Betting Trends

When I first looked at the information from the UKGC, I studied the percentage of gross gaming revenue taken from the more popular sports both offline and online, and compared them with one another.

What I found wasn’t necessarily surprising, but it was enlightening.

Football is easily the most popular single sport to bet on overall, but punters are much more likely to place a football bet online than in a betting shop or at a football stadium.

You can see here the overall percentage of sports betting revenues made up by football bets for the remote and non-remote categories:

| Year | Remote | Non-Remote |

|---|---|---|

| 2015/16 | 33.1% | 23.3% |

| 2016/17 | 34.0% | 21.2% |

| 2017/18 | 46.1% | 23.5% |

| 2018/19 | 49.2% | 30.3% |

| 2019/20 | 48.6% | 26.6% |

| 2020/21 | 46.1% | 28.6% |

| 2021/22 | 46.4% | 31.4% |

| 2022/23 | 47.1% | 31.6% |

It’s clear to see that football fans prefer to bet online, although when there a big competitions you notice a spike in non-remote betting activity. The 2018 World Cup and the 2020 Euros (held in 2021 due to covid) make sense of the spikes in the table above, probably as people were at pubs watching the games and so made bets at the nearby bookies.

When it comes to horse racing (and dog racing for that matter), it’s the opposite.

Here are the betting trends for horse racing fans:

| Year | Remote | Non-Remote |

|---|---|---|

| 2015/16 | 19.8% | 42.4% |

| 2016/17 | 22.3% | 41.7% |

| 2017/18 | 27.2% | 40.8% |

| 2018/19 | 25.4% | 38.0% |

| 2019/20 | 28.1% | 39.7% |

| 2020/21 | 32.4% | 39.2% |

| 2021/22 | 32.1% | 37.3% |

| 2022/23 | 32.1% | 37.7% |

You can see that there is actually a downward trend for non-remote betting on the horses and an upward trend for remote betting, which may seem like it disproves my point, but in actuality this follows the general decline in money taken at racecourses, which would explain things.

When I think about the people I see in betting shops, the majority are studying form or watching races, so it makes sense that the stats show a higher percentage of GGY being taken on the horses in the non-remote category.

Betting on the horses is just more fun with other people, it’s a more communal activity that could actually be classed as a hobby in and of itself. Horse racing enthusiasts like to talk to other like-minded people and swap opinions and stories.

It’s not really like that for a W/D/W on the footy, or a next set winner at tennis.

Speaking of tennis, this sport has had a strange dip in popularity since 2018, while other sports like golf have seen a steady rise. Quite honestly, I can’t understand the change here.

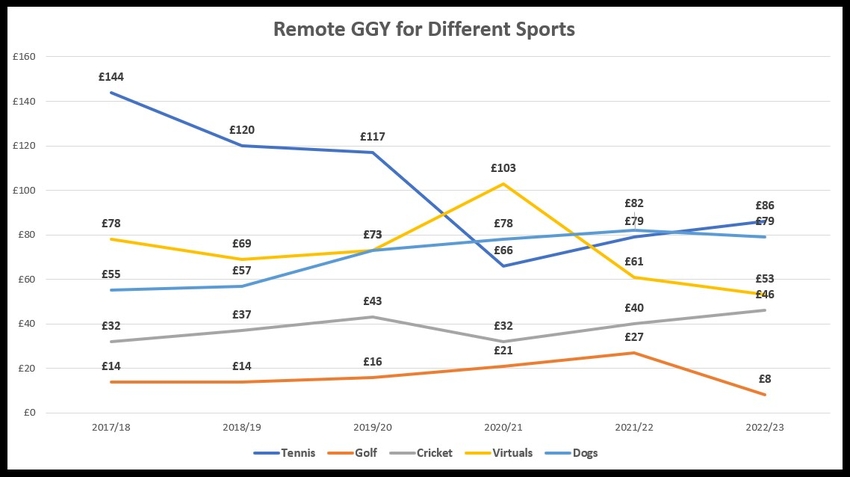

The data I have annoyingly lumps many of the sports in together simply as ‘Other’, but I can see the finer details of those shown in the chart below:

This only applies on remote betting, so online wagers, but it shows that punters are experimenting with what they choose to bet on outside of the major sports.

The jump in interest around virtual sports in 2020 is understandable since most real sports were put on hold during the pandemic, but there was a surprisingly high level of interest even before then, and greyhound racing looks much healthier in the remote category than it does in real life.

Perhaps the frequency of events helps here in both instances, and punters who just want to bet on anything while they have a few minutes to kill can easily find a market in these categories.

Bettors seem to have found the love for golf too, which has seen one of the most impressive jumps in popularity, taking 100% more in 2022 than it did in 2017. Perhaps people are waking up to the value that can be found in golf? Until 2023 of course, when golf betting appears to have fallen off a cliff, for no reason that I can understand.

Bettors Abandoning Pool and Exchange Betting

Pool betting has been around for the longest time, and although it has never been as popular as fixed odds betting in the modern era, it has always had its place.

Exchange betting caused something of a scare for traditional bookies when it came along in the late 1990s and began gathering pace, but it never took over the industry in the way some feared it might.

Nevertheless, both alternative ways to bet have always had plenty of supporters, but what has been happening in recent years, is that bettors are gravitating more and more towards fixed odds betting.

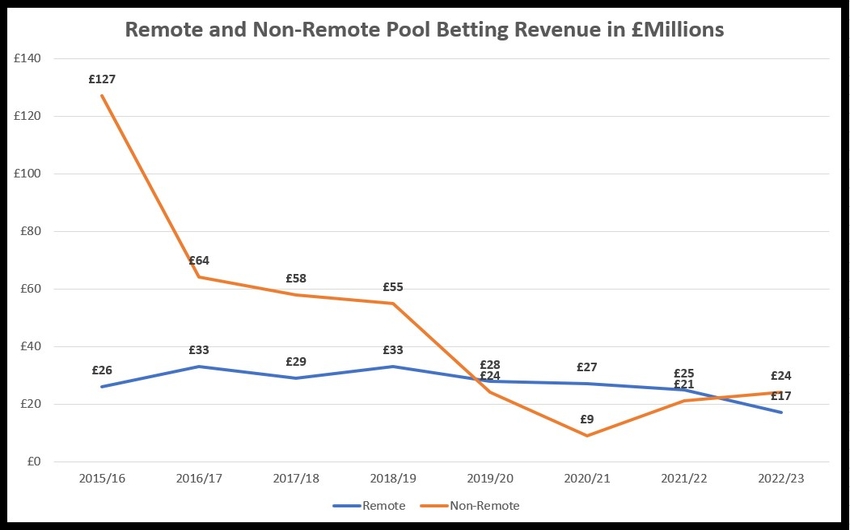

Pool betting has seen the sharpest decline in popularity, largely because of a lack in availability in betting shops once Betfred lost the exclusive rights to the tote, but even looking at online sales, pool betting is at its’ lowest point since the UKGC started keeping detailed records back in 2015.

Here is the decline in revenue from pool bets both online (remote) and in shops or on course (non-remote):

The drop in non-remote pool betting is impossible to miss, even if we disregard the extra dip in 2020 that was due to betting shops and racetracks being closed for covid lockdowns, which it has since recovered from, if you can call it a recovery.

The drop in remote pool betting revenue is much more subtle, but note that in 2023 it was £9 million less than it was back in 2015, a 34.6% drop and the lowest GGY for online pool bets ever.

What’s more, if you factor inflation into this it’s even worse. £26 million in 2015 would be worth more than £34 million today, yet the 2023 figure was just £17 million. In real terms then, the drop in revenue is much more pronounced.

The Tote is doing a grand job of promoting pool betting, but they simply don’t have the same reach or resources as Betfred.

Obviously, exchange betting is only available online, so we can’t compare remote and non-remote figures, but nonetheless, the fact that it too is at its lowest level of gross gambling yield ever tells us something.

The GGY each year from 2015 to 2023, is as follows:

- 2015/16 – £152 million

- 2016/17 – £172 million

- 2017/18 – £169 million

- 2018/19 – £165 million

- 2019/20 – £161 million

- 2020/21 – £136 million

- 2021/22 – £126 million

- 2022/23 – £118 million

So it has been going down every year from 2016 onwards, a 31.4% drop in all, even through covid when online betting experienced an uplift.

Unlike with pool betting then, this decline can’t be explained away by lack of exposure or access to venues, as it is just as available as it has always been, so the only explanation – even taking into account lower commission rates and offers perhaps bringing down revenues – is that fewer people are interested in it.

My only take on this is that bettors would seemingly rather pay for certainty. You know what you are going to get with fixed odds, and the slightly increased odds you might get on a £10 bet on the exchange is not worth the trouble to them.

Perhaps the betting exchange has become a place mainly for professionals to take each other on, and for bookies to use to balance their books?

On Course Betting Suffering Since Covid

When lockdown ended and the racetracks re-opened, the horse and dog racing industries hoped that punters would flood back through the gates of courses up and down the country.

When lockdown ended and the racetracks re-opened, the horse and dog racing industries hoped that punters would flood back through the gates of courses up and down the country.

What seems to have happened instead, is that punters forgot they ever used to go at all.

The horse and dog racing industries have certainly suffered in recent times, although for dog racing the decline in revenues has been like a slow rot, not helped by the closure of Belle Vue in 2020.

In fact, going by the on-course revenues alone, greyhound racing is all but dead in the UK, only in operation because of online wagers being made.

This table shows the severity of the decline in on course bookmaker revenues at Greyhound tracks since 2008 until 2023:

| Year | Revenue | % Up/Down |

|---|---|---|

| 2008/09 | £3.85 million | n/a |

| 2009/10 | £3.34 million | -13.24% |

| 2010/11 | £3.04 million | -8.98% |

| 2011/12 | £3.09 million | +1.64% |

| 2012/13 | £2.89 million | -6.47% |

| 2013/14 | £1.96 million | -32.17% |

| 2014/15 | £1.79 million | -8.67% |

| 2015/16 | £1.92 million | +7.26% |

| 2016/17 | £2.07 million | +7.81% |

| 2017/18 | £1.68 million | -18.84% |

| 2018/19 | £1.62 million | -3.57% |

| 2019/20 | £1.10 million | -32.09% |

| 2020/21 | £0.33 million | -70.00% |

| 2021/22 | £0.55 million | +66.66% |

| 2022/23 | £0.85 million | +54.54% |

Yes, that really is an annual revenue of just £550k for on course bookies at the dogs in 2022.

The industry didn’t just fail to recover from the covid crash, it technically did worse, because the tracks were open for the whole year (not locked down for half of it) but still only managed to take £20k more in revenue than in 2020.

Devastating for on-course bookies at dog tracks.

There has been a slight uplift as of 2023, but we are still way behind 2008 levels.

The horse racing industry is in much better shape, but it is not exactly thriving.

The big meetings on the racing calendar are still very well attended of course, but the every day meetings continue to suffer.

Total on course betting revenues (so dogs and horses) had been holding steady at around £27 million per year for the 5 or 6 years prior to 2020, at which point they saw the crashing drop to just £4 million.

We all know why that happened, but as of 2022, revenues had only recovered around 50% of that £27 million figure, sitting stubbornly at £16 million.

For on course bookmakers this was a huge hit, as many of them rely on the wet Wednesday meetings for their bread and butter, while bigger bookies who still have pitches will find it easier to weather, but for how long?

By 2023, combined revenues were back up to the £25 million mark, but if things don’t improve further, the independent on course bookie will be in real danger of going extinct.

Punters seem to have grown accustomed to staying indoors, a sort of learned agoraphobia is keeping them away, coupled no doubt with the extra cost of making their way to the racecourses, money spent of food and drink while there, etc.

Race course owners will have to do something to encourage spectators back to the stands, as the money they take from race day punters is a large part of their overall income, and many aren’t exactly flush with cash as it is.