In short, the disposition effect is when someone prematurely sells an asset that is making a gain, whilst holding onto an asset that is losing money. We move to sell winning investments because we want to ensure that we can guarantee ourselves a profit, but we’re also averse to selling investments that are losing because we hope that they still have time to turn and becoming winning investments before too long.

In short, the disposition effect is when someone prematurely sells an asset that is making a gain, whilst holding onto an asset that is losing money. We move to sell winning investments because we want to ensure that we can guarantee ourselves a profit, but we’re also averse to selling investments that are losing because we hope that they still have time to turn and becoming winning investments before too long.

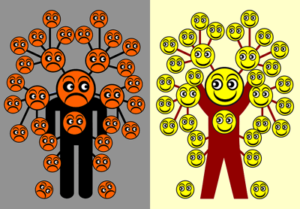

It’s natural for people to try their hardest to avoid losing, given that an aversion to being on a losing side is a common human trait. The problem is that this involves acting on our feelings, meaning that we don’t take all of the evidence at hand into account. In betting, the disposition effect can most clearly be seen in how people react to In-Play betting or Cash Out scenarios, leaping too quickly to take a profit on a winning bet.

What Is The Disposition Effect?

The disposition effect was first labelled by Hersh Shefrin and Meir Statman during the 1980s. They gave it the label that they did because the word ‘disposition’ means a person’s ‘inherent qualities of mind and character’, meaning that they do what they do when falling foul of the disposition effect because it’s natural for them to do so. It was developed out of prospect theory, which looks at losses and gains being valued differently.

The disposition effect was first labelled by Hersh Shefrin and Meir Statman during the 1980s. They gave it the label that they did because the word ‘disposition’ means a person’s ‘inherent qualities of mind and character’, meaning that they do what they do when falling foul of the disposition effect because it’s natural for them to do so. It was developed out of prospect theory, which looks at losses and gains being valued differently.

Also known as the ‘loss aversion theory’, prospect theory shows that when someone is presented with two choices, the first of which will see them potentially lose and the other potentially gain, people will opt for the second option even when they know that the end result will be the same. This is because people just do not like to lose, so they’re more likely to abandon a winning strategy whilst they’re still ahead.

How It Was Proven

There is a strong link between the disposition effect and the work of Daniel Kahneman and Amos Tversky in the theory of behavioural economics. Behavioural economics looks to analyse and understand irrational decision making, which is a bracket that the disposition effect very much fits into. During Shefrin and Statman’s 1985 study, the pair looked at property owners and equity market investors.

There is a strong link between the disposition effect and the work of Daniel Kahneman and Amos Tversky in the theory of behavioural economics. Behavioural economics looks to analyse and understand irrational decision making, which is a bracket that the disposition effect very much fits into. During Shefrin and Statman’s 1985 study, the pair looked at property owners and equity market investors.

What they discovered was that both groups were more likely to sell a property that they owned or a share that they held that had seen its value increase than they were to release one that had seen its value go down. They soon began to study the world of investor trading, the real estate market and the exercise of executive stock options, looking at large databases to see what information they could glean from it all.

Their theory was that people making decisions hope to break even by being correct more often than they are incorrect. Selling something at a loss is tantamount to an admission that we were wrong, so people are loathed to do it. On the other hand, making a profit is proof that we were correct, even if it is only a small profit, so people are more willing to do that. This is in spite of the fact that it ends up being an incorrect decision in the long-term.

Wishful Thinking

Imagine a scenario in which you have bought stock in two different companies, spending £100 on each. One of the companies sees a 30% improvement, sending your stock’s value up to £130, whilst the other takes a 30% loss and is now worth £70. You’ve been given an option to buy stock in another company but you need £50 to be able to do it. Which of the two stocks that own do you sell to make the purchase?

Imagine a scenario in which you have bought stock in two different companies, spending £100 on each. One of the companies sees a 30% improvement, sending your stock’s value up to £130, whilst the other takes a 30% loss and is now worth £70. You’ve been given an option to buy stock in another company but you need £50 to be able to do it. Which of the two stocks that own do you sell to make the purchase?

The vast majority of people will choose to sell the improved stock, allowing them to believe that they made the correct decision to buy it in the first place rather than admit their mistake with the failing stock. Because the failing stock is still ‘live’, they are able to lie to themselves that it has not yet failed and may still bounce back and improve. In reality, such thinking is nothing more than wishful thinking.

It is rarely good business practice to sell stock that is on the rise and keep hold of failing stock, yet people do exactly that time and time again. Cutting your losses is the sensible thing to do for any investor, yet it is something that too many fail to do. It is something that investors should take from practitioners of judo, who learn how to take a fall before they learn how to throw a punch.

The Disposition Effect & Betting

There are numerous different ways in which the disposition effect can be seen playing out in the world of betting. Losing bets will often cause us more angst than winning bets will cause us joy, as evidenced by the annoyance we feel when a bet on a favourite to win ends up losing out to a long-shot, compared to the joy we feel when a long-shot wager pays off. The disposition effect most commonly affects sport betting strategies.

There are numerous different ways in which the disposition effect can be seen playing out in the world of betting. Losing bets will often cause us more angst than winning bets will cause us joy, as evidenced by the annoyance we feel when a bet on a favourite to win ends up losing out to a long-shot, compared to the joy we feel when a long-shot wager pays off. The disposition effect most commonly affects sport betting strategies.

Because we want to be on the winning end of a wager, we will often cut short a winning strategy in order to ‘take the win’. Equally, we’ll have less desire to end a losing strategy because we’re convinced that it will come good, if only we give it time to do so. The major issue there is that mastering betting strategies is an extremely hard thing to do, so not riding out a winning one can be a major mistakes.

Cash out is a good way to show the disposition effect in action. People will often cash out a winning bet close when near completion for fear that it could lose and they can get an immediate gain now. In reality the value in keeping the bet going is greater and over time cashing out early can reduce your overall success. Conversely people often do not cash out a losing bet, hoping it will turn good when it most likely will not. Even though they may not get their stake back it can often make sense to cash out and reduce loses in this scenario.

Influencing Research

It can also have an affect on the way that we analyse and research things. More importantly, it can influence how we use our analysis and research, tricking ourselves into thinking that we got lucky and should get out whilst we are ahead. Think of researching a new Premier League season, being in a position where we think that Liverpool are being undervalued by the bookmakers so we have a bet on them winning the league.

It can also have an affect on the way that we analyse and research things. More importantly, it can influence how we use our analysis and research, tricking ourselves into thinking that we got lucky and should get out whilst we are ahead. Think of researching a new Premier League season, being in a position where we think that Liverpool are being undervalued by the bookmakers so we have a bet on them winning the league.

We’re 15 games into the season and Liverpool are six points clear at the top. Rather than trusting our research that showed that they were being undervalued, we decide to Cash Out our bet that gives us a small profit. We would stand to win a significant sum of money if we stuck with it, but we begin doubting ourselves and our research, instead preferring to walk away with a definite something rather than a perceived nothing.

Alternatively, imagine a world in which we think Everton are going to finish in the Champions League places. They’ve got a new manager and made some new signings, so we feel positive that they’re going to be competitive. Now after 15 games of the Premier League season we’re in a position where they’re in the relegation zone, but rather than take the loss and Cash Out our bet we believe that their fortunes will change.

It is not the case that our research into Everton pre-season was wrong, but they have suffered a couple of serious injuries and the manager hasn’t been able to get the players playing as well as he’d like. As a result, they have suffered some losses that we didn’t see coming and that went against the grain of expectation. Really we should cut our losses over them, but we’re loathed to allow ourselves to do as much.

Avoiding The Disposition Effect

There are ways to help ourselves avoid falling for the disposition effect. As with so many of the things that we’ve explored around the psychology of betting, the most important thing that we can do is to be honest with ourselves. This involves being self-critical and acknowledging when we’ve got stuff wrong as much as when we’ve got stuff right. Positive betting is great, but knowing we’ve made mistakes is also really important.

There are ways to help ourselves avoid falling for the disposition effect. As with so many of the things that we’ve explored around the psychology of betting, the most important thing that we can do is to be honest with ourselves. This involves being self-critical and acknowledging when we’ve got stuff wrong as much as when we’ve got stuff right. Positive betting is great, but knowing we’ve made mistakes is also really important.

When you’re looking at a bet that you’ve made, ask yourself a question: is it likely to get better? You need to combine this question with research into that very matter, ensuring that you are answering it genuinely. In the case of Everton being in the relegation zone, for example, how far off the Champions League places are they? Is it a tight season and they’re actually only four points away, or are the cut adrift and 15 points shy?

Just as important is to look at what might change for them. Are their key players returning from injury? Or have they been removed from their squad for the rest of the campaign? In both cases, the former might suggest that your bet isn’t just a pipe dream, so it may actually be worth holding on to it for a bit long. The latter, on the other hand, is evidence that the bet is going to be a losing one and you need to cut your losses.

The very best bettors in the business know what it takes to cut their losses and ride their wins. They will generally steer clear of the Cash Out option on a bet when it is going well and will keep playing with a system that is working for them. Conversely, they will move to make sure that they can get out of a bet that is obviously heading in the wrong direction, seeing no shame in calling it a loser when it is clearly going to be.

Gambling Has No Room For Ego

No bettor in the history of the world has never had a loss. They might downplay the losses that they have had, or those losses might prove to be insignificant in the grand scheme of things, but everyone has had a loser or two in their time. That is the nature of betting and it is important to learn to take the rough with the smooth. As a consequence, there is no room for ego when it comes to placing bets and keeping track of your profit and loss.

Arrogant people will be desperate to ignore their losses, so they will often allow them to keep playing out even when they know that they’re not going to win. They will instead take their profits as soon as they appear, believing that this further ‘proves’ that they are winners. The fact that they would have made more money if they’d ridden their winners for longer is something that they happily manage to ignore.

One of the best things that you can do is to ask yourself whether or not you’re allowing your ego to get in the way of your betting. Are you refusing to acknowledge that you’ve placed a losing wager, instead burying your head in the sand and hoping that it will turn out ok if you just wait long enough? Equally, are you playing up the achievements of your ‘wins’ and taking them earlier than you should?

It is crucial to successful betting that we do not undervalue our wins or overvalue our losses. We need to be brutally honest with ourselves when looking through our profits and losses, making sure that we don’t lie to ourselves about how we’ve done. That is the only way that we can avoid falling into all of the various betting pitfalls, but especially one that actively requires us to lie to ourselves in order to take hold and fester.

Problem Bettors Are Especially Vulnerable

Those that develop gambling problems have to be especially careful that they’re not falling foul of the disposition effect. The reality is that none of us want to admit that we’ve got a problem, so we will often overplay our wins and downplay our losses. We’re especially like to do this if we’ve got a betting problem, ignoring losses in the hope that they will change and become wins or taking small wins to ‘prove’ we’re on the right path.

Those that develop gambling problems have to be especially careful that they’re not falling foul of the disposition effect. The reality is that none of us want to admit that we’ve got a problem, so we will often overplay our wins and downplay our losses. We’re especially like to do this if we’ve got a betting problem, ignoring losses in the hope that they will change and become wins or taking small wins to ‘prove’ we’re on the right path.

It is especially evident that people can fall foul of the disposition effect when they are required to talk to others about their gambling. Instead of being honest about getting it wrong, those with an unhealthy relationship with gambling will exaggerate their wins and pretend that their losses aren’t significant. If you find yourself doing such a thing then it is more important than ever that you adopt a policy of being honest with yourself and others.