Ever since betting shops were legalised in 1960 there have been big betting companies that have dominated the market. Even those who do not bet could tell you who William Hill, Betfred, Coral, Ladbrokes and Paddy Power are given they have a shop on pretty much every major high street.

Ever since betting shops were legalised in 1960 there have been big betting companies that have dominated the market. Even those who do not bet could tell you who William Hill, Betfred, Coral, Ladbrokes and Paddy Power are given they have a shop on pretty much every major high street.

These companies monopolised the betting industry for a long time, but the invention of the internet and online gambling changed everything. In the space of just two decades a new breed of mega gambling company has emerged that now dwarfs the old high street companies.

In the early days of betting, online companies were mainly independent and the market was still mostly cornered by the old high street names that retained their position at the top. New online-only companies emerged, such as bet365, who over the space of ten years became big enough to compete with the old names. Most of these companies heralded from the UK, which helped make Britain’s gambling companies the biggest in the world.

From the 2010’s onwards many of the old high street giants and the early online-only betting companies that had grown big, such as Betfair, began to merge to create new colossal gambling companies. Coral (including Gala) and Ladbrokes merged in 2016, for example, to create Britain’s biggest gambling company at the time, but this lasted just two years before the Ladbrokes Coral Group were bought by Entain Plc (formerly GVC, who also own brands such as PartyPoker and Bwin) to create an even bigger company with annual revenues these days of over £4 billion.

It is a trend that is growing too; Betfair and Paddy Power merged in 2015 and in 2020 that company (renamed Flutter Entertainment) merged with The Stars Group (owner of brands such as PokerStars) to create an even bigger company than Entain. And since the PAPSA law was passed in the US in 2018, which allows individual states to set their own gambling laws, the big Vegas gambling companies have started to buy up old British companies due to their long experience and robust online platforms. In late 2020 a deal was agreed for Caesars Entertainment to buy William Hill for over £2.9 billion. MGM also had a failed bid in 2021 when trying to purchase Entain for over £8 billion.

As with most new markets, given enough time the independents become fewer and fewer, as monopolies begin to form and grow, swallowing up the ‘little man’. These new gambling giants are akin to the likes of Amazon and Google in that regard – they can make buyout offers that are very hard to turn down.

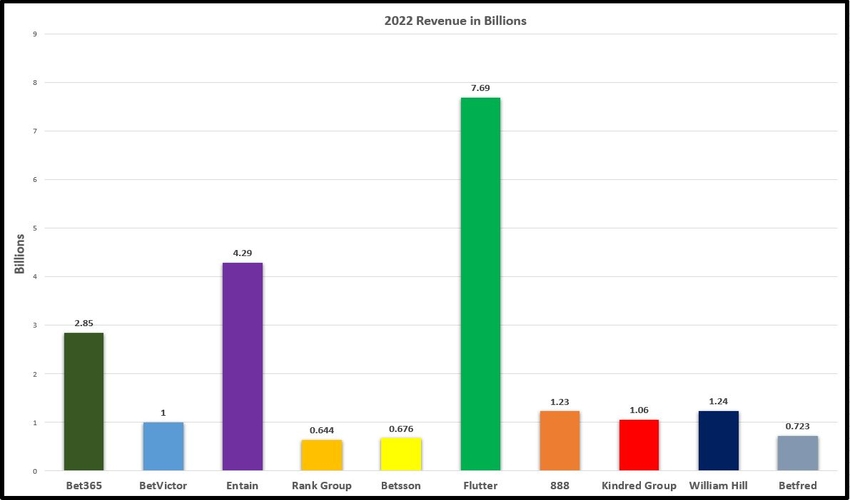

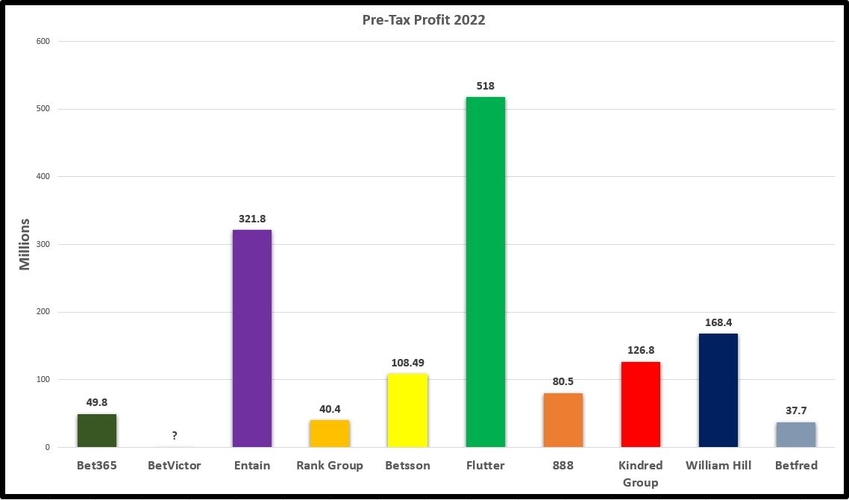

On this page we look in depth at the biggest gambling companies and groups in the world in terms of revenue, profit, brands, customers and more. We look back at the biggest mergers, buyouts and major developments.

Biggest Gambling Companies

The UK Gambling industry is almost as much of a roller coaster ride as the act of gambling itself, what with constant changes in the law, new regulations, mergers, acquisitions and closures.

The last few decades have also seen rapid changes in terms of how much we can bet and what we can bet on, as well as how we do it. The online space has exploded with new betting features and bet types, and this has attracted new customers in their millions.

If we look at the industry in 2011, by which point the online revolution had been given plenty of time to establish itself, the gross gambling yield in the UK was £8.4 billion; fast forward just 6 years to 2018 and that number had jumped to £14.4 billion, a 71.4% increase.

That number has remained more or less the same since, showing a slow down in growth perhaps, but also showing no signs of decreasing. But of course, the UK isn’t the only market in which this gambling behemoths trade – many are global.

The big players in the industry have also found themselves in an increasingly saturated market as new companies pile into the fray, attracted to the money generated by gambling businesses. This has meant they have had to find new ways of doing things, and one of the best ways to remain a leading force in a competitive industry is to make sure you have the biggest muscles.

Growing organically at the pace required wasn’t realistic for many big brands, so instead they clubbed together to form gigantic corporations, combining forces and resources in order to stay dominant.

This means big outlays now for much bigger rewards later, which is why some companies’ 2022 profits might look low compared to their revenues – they have shelled out millions and millions in buying up smaller firms which will go on to greatly increase their revenues.

Of course, they have also had an economic downturn and a tightening of regulations to contend with in recent years, plus rising interest rates making their borrowing more expensive.

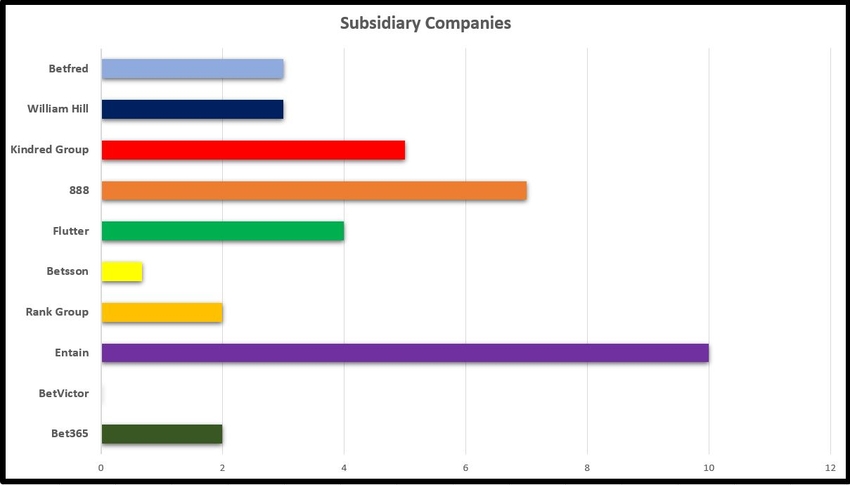

This has led to the creation of the likes of Flutter Entertainment (Betfair/Paddy Power/Others), Entain plc (Ladbrokes/Coral/Others) and Betsson (Betsafe/Racebets/Others) – massive parent companies operating many other brands, some targeting different regions or customer demographics but all ultimately serving to strengthen the umbrella company at the top.

Other big names such as Bet365, William Hill and Betfred have done things differently, remaining largely as a single brand company but focusing their efforts on expansion to new markets, making acquisitions that are folded into the existing company rather than running underneath it, solidifying their brand identity and retaining their customer base while doubling down on attracting new customers.

On top of this, these companies create or acquire subsidiaries which exist to help the business run, such as a software company for example, or a platform developer.

Biggest Gambling Company Mergers and Deals

The merger of two companies, or the acquisition/take over of one by another, is a mammoth task and one that can take quite some time to execute. This is because of the various rules, regulations, and legal dealings that have to be dealt with, and every box has to be ticked.

That means the two parties need to be absolutely sure the deal is worth doing, and to work that out numerous meetings need to take place to draw up new business strategy, future growth plans and revenue expectations, how the market might change, etc.

Essentially it needs to be profitable for all parties and this is why the deals between these gigantic companies are often publicised as being worth billions of pounds. There is a lot to factor in and it all adds up.

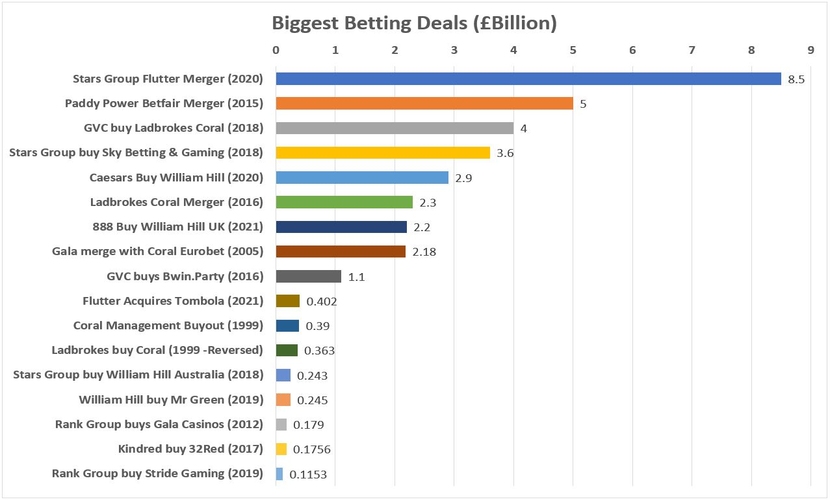

With so much money flowing through the gambling industry though, this weighty price tag can often look like good value to those at the top who stand to profit in the long run, and if you look at the data most of the biggest deals, those climbing into the billions, have occurred since 2015 and with a huge gulf between them and next biggest deals too.

This indicates that the industry is changing. Thanks to the internet the world is getting smaller, and for many companies accessing new markets is a key priority but a difficult task. Much better to come together with pre-established brands already operating in other markets under one single umbrella or parent company and share the benefits that way. Not only does the customer base increase in number and range, but those customers can be directed to other brands in the same group to some degree, giving the parent company an element of control.

Cost saving synergies come into it too – why run 3 different brands on 3 different betting platforms when you could bring them all onto the same platform and run it in house? Companies save hundreds of millions per year doing things like this.

There is also the question of regulation and taxes which are both becoming more prohibitive and very expensive if having to tackle them alone, as well as the fact that businesses are becoming more and more careful and want to diversify their revenue and spread their exposure. A big poker brand joining forces with a sports betting giant, for example, can do this in one fell swoop.

This is why so many companies are joining forces and operating a multi-branded approach to the future. Not to mention the other benefits such as sharing technical capabilities for those conglomerates that also offer B2B services likes sportsbook and casino platforms. Why run 3 different brands on 3 different betting platforms when you could bring them all onto the same platform and run it in house? Cost saving synergies like this can save companies hundreds of millions per year.

BetVictor

Victor Chandler, the son of BetVictor’s founder (also called Victor Chandler, Snr), was one of the first to move his company’s operations off shore for tax purposes. This sparked something of an exodus as others followed suit, and also symbolises the personality of the company – independent and bold.

The company actually started at Walthamstow Dog Stadium in the 1940s thanks to Chandler Snr’s father, William Chandler, then ran high street bookies until Chandler Jnr predicted the boom in online gambling and went fully digital. Being one of the first to market really helped BetVictor to dominate.

They have also used sponsorship to good effect, in line with their branding as the high class bookmaker, the gentleman of the industry. BetVictor are a rarity on this list because acquisitions haven’t really featured in their climb to the top, although changes behind the scenes mean the firm is almost unrecognisable now from the pre-2014 era.

Entain Plc

Although the company has roots going back to 2004, it wasn’t until 2018 that Entain really became prevalent to UK punters, when they successfully took over the Ladbrokes Coral group, although they were still known as GVC at the time.

As they already held interests in various other jurisdictions around the world this turned them into a huge force, and officially made them one of the biggest online gaming businesses on the planet.

Their 2016 acquisition of the struggling bwin.Party brand saw them join the FTSE 250, and just a few short years later they joined the FTSE 100 with the purchase of Ladbrokes Coral, and much more was to come.

Rank Group

The Rank Group’s history is actually rooted in film and cinema, and the brand still use the man hitting the gong logo that millions of movie fans saw at the start of their many films. In 2006, however, they sold the last of their interests in this industry and became solely focused on gambling.

The group are responsible for 3 major brands (plus smaller online brands), but unlike most other organisations on this list those brands operate in the real world as a first port of call, as well as online. Mecca Bingo and Grosvenor Casinos can be found in many towns and cities around the country, as well as running online casinos, while Enracha is a well known bingo and casino brand in Spain.

Although the group operates in Spain, 91% of their revenue comes from the UK, and they are listed on the FTSE 250.

Betsson Group

Betsson AB has had more stops on its journey than most other big gambling companies, and although the name comes from a British brand the company’s history is mainly in Europe.

Betsson is/was a British sports betting company acquired by a company called Cherry in 2003. The Cherry brand goes back to 1963 in Sweden where they made slot machines, and in 2000 with the dawning of the internet era they took over a little known game developer called NetEnt.

In 2005/6 the company was split 3 ways, with Betsson AB now operating as its own entity and going on to acquire many other brands such as Star Casino and the Nordic Gaming Group, and most recently GiG’s B2C vertical which included online casinos Guts, Rizk, Kaboo, and Thrills.

Flutter Entertaiment

Flutter came about fairly quickly, due to the merger of the recently (at the time) created Paddy Power Betfair, and The Stars Group.

Paddy Power and Betfair, two of the biggest online bookies (and high street bookies in the case of Paddy Power) in the UK market, joined forces in 2016, while the Stars Group was made up of the various Poker Stars offerings plus Full Tilt, Bet Easy, and as of 2018, Sky Betting and Gaming.

Paddy Power Betfair became Flutter Entertainment in 2019, and in 2020 The Stars Group was welcomed into the fold, making Flutter one of the biggest gambling groups in the world.

888 Holdings

The people behind 888 were responsible for one of the first ever online casinos way back when in 1997; Casino-on-Net. Two sets of brothers, the Shakeds and the Ben-Yitzhaks, got things started, although none of them have been involved since 2010.

It was 2002 when the 888 branding first came into use, and although they have been a public company since 2005 they have always aimed to be self-sufficient, re-branding their B2B division as Dragonfish in 2009 which developed proprietary software and platforms for their various gambling products.

The company have made a few acquisitions along the way but have focussed more on developing their own brands and conquering the American market. Bingo and Poker featured heavily in their business plan to begin with, although they took a huge change in direction when they bought William Hill in 2022.

Kindred Group

Unibet was the catalyst for the foundation of the Kindred Group. It is essentially an umbrella company to manage Unibet’s crusade of acquisitions which began in 2007 when Maria Bingo was taken over.

Since then, the Unibet Group as it was previously known snapped up no less than 13 other online gaming brands, before it became the Kindred Group in 2016, to better reflect its multi-brand approach.

More acquisitions followed, most notably that of 32Red, a very well known online casino. The group now serves 25 million customers worldwide from 9 different brands, and is listed on the Nasdaq Nordic stock exchange.

William Hill

As a brand that is almost 100 years old, William Hill is a household name in the UK but has been operating much further afield since 2009, with interests in Australia, Italy, Spain, and most importantly America, where the company had a 38% market share on sports betting.

We say 'had', because in 2020 Hills were acquired by Caesars Entertainment, so any market share they had now technically belongs to Caesars.

Prior to this, William Hill’s approach had been to make acquisitions and then rebrand them under the William Hill moniker, and only the 2019 purchase of Mr Green casino (which is big in Europe) had bucked this trend.

Despite not really adopting a multi-brand approach, William Hill itself has been bought and sold many times over the years, by Grand Metropolitan, Nomura, and Cinven & CVC Partners among others. Caesars went one further by not just buying the company, but splitting it in half and selling on the European interests to 888.

William Hill, therefore, is now two different companies with the same brand name, but still operating in markets all over the world.

Betfred

Proudly based in the North West, Betfred is another household name that started out as a single high street shop. Originally named Done Bookmakers, brothers Fred and Peter financed the shop with money won on a 1966 World Cup bet (England to win!), but it wasn’t until they purchased a rival bookie chain in 1997 that they really began to gather pace.

The Betfred name was adopted in 2004, and although acquisitions have featured in the company’s history they have always been brought under the Betfred brand rather than being added as a subsidiary.

The high street is still a major focus for the company who operate over 1,400 shops, and although the UK had been their sole territory for most of their lifetime they have begun to explore other markets like America and South Africa.

They are synonymous with horse racing, even winning the license to the Tote when the Government sold it in 2011, although the license has since run out, but they somehow retain the ability to be all at once a traditional local bookie, and a world conquering billion pound business.

Bet365

Officially starting life from a portacabin in Stoke on Trent and run by Denise Coates and her father Peter and brother John, Bet365 is one of the biggest privately owned bookmaking companies in the world.

However, the real story starts back in 1974 when Peter Coates opened his first high street bookies as a sideline to his main business as a caterer. Denise took over the family business in 1995, and they used their fleet of high street shops as leverage for a £15 million loan which Denise used to start Bet365.

In 2005 the high street business was sold for £40 million, paying off the debt and making the Coates family and Bet365 an online only enterprise.

Competition & Markets Authority

While all of these acquisitions and mergers are good news for the companies involved and their shareholders, they are not always seen as good news for the country on the whole.

While all of these acquisitions and mergers are good news for the companies involved and their shareholders, they are not always seen as good news for the country on the whole.

This is because when a company grows too big and powerful they become a monopoly, so gargantuan that they can afford to drive down prices and force competitors out of business. This is bad for business in any country, and in the UK it is the Competition and Markets Authority (CMA) that is tasked with keeping things in order.

They might step in if they think a deal is anti-competitive and indeed they have done so a number of times in the gambling industry.

Competition in any market is good for the consumer and good for the economy, so there needs to be a balance between progress and growth, and leaving room for others to get a slice of the pie.

Ladbroke’s acquisition of Coral back in 1998 is one of the most famous examples of the CMA in action, although back then it was called the Monopolies and Mergers Commission; they put the brakes on a £363 million deal.

Ladbrokes had come to an arrangement to buy Coral from Bass plc for the aforementioned sum, and the deal even went through, but after the commission found it to be anti-competitive the Government stepped in and forced Ladbrokes to sell most of the shops they had just bought.

This they did in 1999, all except a meagre 39 shops in Jersey and Ireland which they were allowed to keep. The rest of the Coral fleet was sold in a management buyout for £390 million.

This they did in 1999, all except a meagre 39 shops in Jersey and Ireland which they were allowed to keep. The rest of the Coral fleet was sold in a management buyout for £390 million.

Ladbrokes and Coral actually came together again in 2016, this time as a merger, but once again the CMA got involved and there were a few hoops to jump through. The pair had thousands of shops between them and in order for the merger to go ahead were required to sell between 350-400 of them.

Betfred and StanJames were happy to step in at this point, with the former paying £55 million for 322 of them and the latter taking another 37 for £500,000. This satisfied the CMA who had concerns regarding anti competitiveness in 642 localities across the UK, and the deal went through.

Another example would be when The Rank Group tried to buy 23 casinos from Gala Coral in 2012. The deal would make The Rank Group the biggest casino operator in the UK, with only Genting anywhere close to matching them, so of course the CMA had to take a look at things.

It was decided that 5 casinos would have to be sold to keep things competitive and for the deal to be signed off, so the price was reduced from £205 million for 23 casinos to £179 million for 19. The remaining 5 locations were retained by what is now Gala Casino.

These were all high street brands so it’s easy to understand why the CMA had to step in; if all the betting shops in your local area were owned by the same company there wouldn’t be much incentive for them to offer good prices or deals, which means you, the customer, would be stuck with a like it or lump it scenario.

When it comes to online gambling things are less clear, since the internet is only restricted by jurisdiction, so location is not anywhere near as big a factor.

Timeline of Mergers

Flutter Entertainment acquire Tombola

Sunderland based Tombola had been independently owned by local man Phil Cronin since it was established at the turn of the century, the £402 million in cash offered by Flutter was enough for him to finally let it go.

Flutter also went on record to say they fully intended to keep the business 100% in Sunderland, and to use their massive scale to grow the business and give staff greater opportunities.

Although not a gigantic company in terms of profit and revenue, Tombola is arguably the leading online bingo brand in the country, and the fact that it managed to achieve and hold this position as a relatively small independent company speaks volumes.

They were also pioneers in reducing gambling harm, being the first UK gambling company to introduce mandatory staking and deposit limits.

Flutter emphasized that their marketing expertise mixed with Tombola’s operational capabilities were a great match, and it would also give them a stronger footing in the online bingo world where they had not previously had much to shout about in this area.

Caesars Offload William Hill UK Assets to 888

Even when the Caesars/Hills deal was being arranged, the rumour was that the American giant had no interest in the European side of the business and would probably sell it off.

In September of 2021 this rumour proved to be accurate as online casino stalwart 888 made a £2.2 billion bid for the company’s European interests, including the high street portfolio of 1,400 shops and the Mr Green brand.

The deal would complete in the second quarter of 2022, making 888 an instant high street gambling giant having never previously operated a single physical store in their 25 year history. Yet this was a major reason for 888’s interest in the first place, as they wanted to concentrate on scaling their sports betting and gaming verticals having recently sold off their bingo product.

888 beat off competition from US equity firm, Apollo, and commented that the deal would make them one of the worlds leading betting and gaming groups, giving them significant exposure to the sports betting market with an iconic brand.

Caesars Bid Big For William Hill

Hill’s and Caesar’s Entertainment were already working together at the time of the takeover, with William Hill offering sports betting facilities in many of Caesar’s venues in America. As William Hill began making some serious headway in America though, Caesars swooped in to buy the company out rather than having them as a competitor.

Their sports betting capabilities were first class, especially in comparison to American companies like Caesar’s who had never bothered developing their own products since sports betting was mostly illegal in the states for so long.

The sale was agreed at £2.9 billion after another bidder, Apollo, was batted to one side, and Caesar’s announced that they would look to sell on the non US assets, as their aim was to bring their sports betting, real world casino, and online gaming divisions together.

This was another deal that was part of the gold rush for the newly regulated United States, where the online gambling industry was expected to grow exponentially over the next few years.

The Stars Group (TSG) Flutter Entertainment Merger

News broke in 2019 that these two gambling giants were attempting to merge to create the first global gambling organisation, and the deal was confirmed in May 2020.

Said to be worth $11 billion (£8.5 billion), the deal saw Flutter buy all of TSG’s shares so the two could join forces creating an estimated annual revenue of £3.8 billion.

The group was organised into five arms; TSG International (Pokerstars excluding the US), PPB Legacy (Paddy Power, Betfair, Adjarabet, Paddy Power Retail and B2B Services), Sky Betting and Gaming Assets, Sportsbet Australia, US Unit (FanDuel Group and TSG US).

These five arms would run with a strong degree of independence rather than being run by top management.

William Hill Acquires Mr. Green

In an attempt to strengthen European prospects and reduce exposure to UK markets, William Hill bought popular European online casino Mr Green for £242 million.

The company also held licenses in a number of jurisdictions including Malta which, among the uncertainty surround Brexit at the time, was another attractive aspect for Hills.

Because of the company’s strong international reputation, William Hill did not rebrand Mr Green as it had with previous acquisitions, instead choosing to let Mr Green operate as its own entity.

Paddy Power Betfair Acquire FanDuel

After law changes in the USA opened the door to legalised sports betting, there was a rush for the American market, and Paddy Power Betfair as they were the known made a play for FanDuel, a popular American fantasy sports betting company.

The deal was technically a merger, although FanDuel would become a subsidiary of PP Betfair and be run by the Dublin based company. Paddy Power took 61% of the combined business in exchange for $612 million (£470 million) of US assets and $158 million (£121 million) in cash.

The deal bought the company a ready made American customer base to add to their existing customers, since the firm had also acquired DraftKings a year earlier as well as having other American business interests.

Stars Group Acquire Sky Betting & Gaming

Costing a combined $4.7 billion (£3.6 billion) in stock and cash, TSG’s acquisition of Sky Betting & Gaming created the world largest publicly listed online gaming company at the time.

As well as creating savings of $70 million per year, the takeover gave TSG excellent access the UK sports betting market as SkyBet was one of the biggest operators in the space, and it also allowed them to diversify their revenue streams and improve mobile capabilities.

The deal was unanimously approved by the Stars Group board.

As for Sky, they were keen to expand their international footprint and The Stars Group were able to offer them that opportunity.

GVC Acquires Ladbrokes Coral

The holdings company ended 2017 by splashing out on the recently formed Ladbrokes Coral, who were the biggest high street bookmaker in the country with 3500 shops, in a deal worth up to £4 billion pounds.

They also formed a monster gambling company as bwin.Party, Foxy Bingo and Casino, Betboo, and other brands were already operating under the GVC umbrella. This made them one of the biggest in the world, immediately listing on the FTSE 100.

Indeed, geographic diversification was a major factor, especially given the uncertainty surrounding regulation at the time, and it also gave GVC access to the retail market as well as strengthening their online business.

Kindred Group Buy 32Red

It cost the Kindred Group £175.6 million to get the keys to 32Red, at which point they were delisted from the AIM market and folded into the group.

This purchase gave Kindred a much stronger foothold in the UK online casino market, as even though Unibet had an online casino it was better known for its sportsbook, and most of the other brands in the group either weren’t licensed in the UK or weren’t as well known as 32Red.

The deal also bought them Roxy Palace casino which had been acquired by 32Red in 2015.

Ladbrokes Coral Merger

The two well known companies had flirted with each other a number of times in the past, but in 2016 those kids finally got together to form a company worth £2.3 billion.

Both brands were major high street players as well as offering online services, so there was a bit of a tussle with the authorities who were concerned about certain areas becoming anti-competitive, but after the sale of a few hundred shops the deal was good to go.

Ladbrokes plc and Gala Coral became one, two historic brands and household names with a combined age of 220 (in 2016) and dreams of international expansion. They immediately moved for a premium listing on the London Stock Exchange under their new company name, Ladbrokes Coral Group plc.

GVC Acquires Bwin.Party

It took them five months of fighting it out with 888 who were also chasing the deal, and it cost them £1.1 billion, but eventually GVC Holdings were chosen to acquire the Bwin.Party group, created when Bwin and Party Casino merged in 2010.

It was unclear whether GVC or 888 would come out on top right up until the very last, and after both made final bids the decision was eventually made by discreetly polling the company’s shareholders.

One of the key factors was GVC’s higher bid, but it wasn’t all down to money. Integration would also be simpler with GVC than with 888, and fewer bumps in the road were expected. Nonetheless, this was not a simple acquisition.

Paddy Power Betfair Merger

This could be considered the first of the modern day super company mergers, estimated to be worth £5 billion at the time and creating one of the worlds biggest online gambling companies, with terms agreed in 2015 and the deal completing in Feb 2016.

The two brands were major players in the industry, both innovators albeit with very different brand identities, but this is what made the merger make sense – they targeted completely different types of customer. The newly formed company’s HQ would be in Dublin, largely down to Paddy Power being the dominant partner with 52% of the shares leaving 48% to Betfair shareholders.

With estimated annual sales of £1.2 billion and £50 million saved annually due to synergising, the deal was equally beneficial to both parties, and although 80% of their business came from online revenues, Paddy Power’s high street presence would also continue to play an important role.

Gala Acquire Coral Eurobet

Way back in 2005 the online potential was only one factor in this deal, said to have cost £2.1 billion and creating the Gala Coral Group. However, the combination of Coral’s established online product and Gala’s web based products was recognised as a significant benefit for the future.

When the group was formed they became the UK’s largest bingo operator with 167 clubs, a major player in the casino world with 30 venues, and the third largest high street bookmaker with 1,267 shops.

The deal was backed by Cinven, a European private equity firm, and created an enterprise value of around £4 million.