Despite all the knowledge that we possess as humans we are still animals and that means we are all influenced by inherent biases and other tendencies that can lead people to fall into the same traps time and time again.

Despite all the knowledge that we possess as humans we are still animals and that means we are all influenced by inherent biases and other tendencies that can lead people to fall into the same traps time and time again.

When gambling we are either betting on random chance or luck, as with most casino games, or we are betting that we can predict something to be true, as with most sports bets. We know that the house always wins on average but those that bet rationally and can control their biases and natural tendencies can do better in the long run.

Of course, sportsbooks and casinos know very well how to exploit the psychology around gambling to take advantage of customers. Therefore, it is critical to understand what the psychological factors are present when betting and how to stop yourself falling into the same old traps.

Here we break down various psychological tendencies to hopefully help you to make your decisions around gambling more rationally. There is a bit of science thrown in to explain why biases work the way they do but don’t worry, these articles are designed to be understood by the typical punter too.

Gambler's Fallacy

Of all the biases you will read about on this page this is the one that most people will recognise. Just because you know about something though doesn't mean you don't end up falling for it. Gamblers fallacy, known in psychology circles as cognitive bias, is a trick of the mind that makes you think that an outcome is more or less likely to happen based on previous events. In random situations this is not the case.

Also referred to as the Monte Carlo fallacy, named after the casino where it was first observed, it reflects the human propensity to find patterns in what should be considered independent results. The idea that on a roulette wheel if black has come up ten times then surely the next spin must be red, in reality the odds are exactly the same each spin.

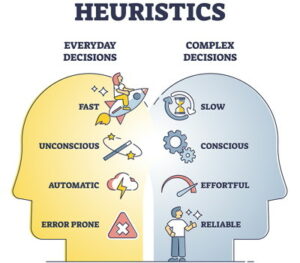

Availability Heuristic / Availability Bias

Availability heuristic or availability bias is the tendency we all have to assign more importance to events that affect us more, are easier to remember or make a big impression on us. The idea that you may drop someone at a train station and say ‘have a safe journey’, when in reality they should say that to you as the risks of death and injury on the roads is far higher than on trains.

This can be summed up as something that causes us to misjudge the real probabilities of events occurring, which can have a very obvious impact on gambling. Here we explore how availability heuristic applies to betting and how you can avoid it.

The Green Lumber Fallacy

The Green Lumber Problem was described by Nassim Nicholas Taleb in his book Antifragile: Things That Gain From Disorder. It is based around the idea that one of the most successful men in trading wood, Joe Siegel, made a lot of money selling green lumber, believing for his entire career that it was painted green, when in fact it was only green because it was fresh wood.

The basic principle is that you don't need to understand the intricacies of how something works in order to exploit it. What many people regard as 'knowledge' is in fact unimportant. This obviously applies to betting, where people may believe because they 'know' a sport they will be more successful betting on it. In fact, the most crucial thing is understanding the market itself.

Hindsight Bias

Hindsight is a wonderful thing, or so the saying goes, but in reality hindsight can be a dangerous thing as it can make us believe, falsely, that we knew something was going to happen all along. Of course in betting that can lead to bad future decisions and subsequently loses.

You don't need to be a psychologist to know about hindsight but despite the fact we all understand what it is doesn't necessarily stop us falling into the trap. Hindsight bias is actually more powerful when a negative result happens than a positive result. Find out more.

Confirmation Bias

Of all the inherent human biases we talk about on this page confirmation bias will be the one people are most familiar with it. Still, just because people know what it is doesn't stop them being influenced by it, like most biases it affects us mostly on a subconscious level and so we need to actually think about it to stop us being led by it.

Confirmation bias is the idea that we let our opinions, prior beliefs or previous happenings affect our future decisions. This has a very obvious influence on betting and gambling.

Hot Hand Fallacy

We've all been in the position where we think we are 'on a run' and that we can't seem to get anything wrong, every prediction coming true in turn. In sports and betting this is referred to as a 'hot hand' and it can lead to the mistaken belief that we have more control over future events than we actually do.

While it may be true that people can be 'in the zone' it doesn't mean they can overcome random chance and just because you've won ten bets in a row it will have no impact on the outcome of your 11th bet. This is kind of the opposite to the gambler's fallacy, there if black came up ten times in a row on the roulette wheel you would mistakenly think betting red is the better option. With the hot hand fallacy because you won ten bets in a row on black you would believe it will more likely be black again the next time.

Sunk Cost Fallacy

A sunk cost is basically money or time or effort we have already expended doing something. The issue comes in how people view a sunk cost. Many people allow costs they have already experienced to influence their future decision making, which has an obvious implication for gambling.

Those people that chase loses or place bets to try to win back money they have already lost are falling into the sunk cost fallacy. On this page we explain what sunken costs are, how they relate to gambling and, importantly, how to avoid them influencing your future decisions.

The Ostrich Effect

This is one of the more obvious human biases to explain. There is a commonly held belief that Ostriches bury their heads in the sand, this is actually not true, but the myth persists. It doesn't really matter if it is true or not the point is the image is designed to represent what happens when people ignore information and 'bury their heads in the sand'.

The implications for betting and gambling are also fairly obvious but despite that fact many people will suffer from the Ostrich Effect time and time again. Read more about about it and critically how to avoid it.

Outcome Bias

Simply put outcome bias is the process by where we allow the result of something to impact our evaluation on how good our original decision was. The fact is people can make good decisions but will sometimes still get a bad outcome, that doesn't mean the process by which you made the original decision was flawed, however.

In gambling people will often see a losing bet as a bad decision but bets can lose for all sorts of reasons and it doesn't mean you were wrong to make that decision. It doesn't necessarily mean you shouldn't bet that way again. Discover more about outcome biases and how to avoid them negatively affecting your gambling.

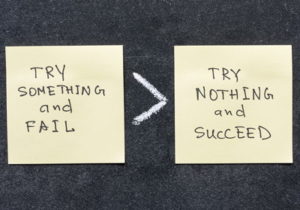

Action Bias

Action bias is the human tendency to feel that doing something is better than doing nothing. It is the thing that motivates people to swap queues in the airport check-in line or change lanes in a traffic jam. People generally feel they should at least try to do something than do nothing at all. For example, goalkeepers will generally always dive when a penalty is taken, yet statistically they would be better doing nothing and standing still in the middle of the goal.

The issue comes when we make quick decisions that we do not prepare for. This has a fairly obvious implication for betting. The idea that if you see a horse in a race and maybe you like the name then you feel you should take action and bet on it, because if it wins you will feel like you failed. In reality a bet like that would be a bad decision as we have little knowledge of the horse or its chances of actually winning.

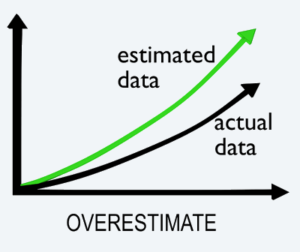

Overconfidence Effect

Overconfidence is simultaneously the most dangerous cognitive bias and the most common at the same time. If you think about almost every financial crash we have had it has its roots in overconfident traders. Gambling is very similar and many people who have experienced loses will put at least some of this down to overconfidence.

While it is important not to question yourself too much either, being overconfident can be just as damaging. Evidence shows that people who believe they are certain about something are wrong as much as 40% of the time. It is often easy for us to spot overconfidence in the aftermath of an event but how can be avoid it in the first place, especially when betting?

Optimism / Desirability Bias

Optimism or desirability bias is one of the more obvious ones to explain and it also affects virtually everyone at some point. It is basically the process of backing a specific outcome not because we think it will happen from an objective stand point but rather because we want it to happen.

An underdog playing in a football match, for example, is highly likely to lose but fans of the underdog team (or fans that want the bigger team to lose) will often bet on the more unlikely outcome. In a casino you may place a bet on a specific number on a roulette table because it means something to you and this makes you more optimistic of an outcome than the real probabilities suggest.

While the bias is obvious it is very hard to ignore, all of us want certain things to happen and this is part of the motivation of betting. It is important to recognise optimism bias, though, as it can lead to compulsive gambling and long term loses if you cannot identify and control it.

Conservatism Bias

Some people are very open to new ideas, change and new information, others are more predisposed to rely on existing or historical information and give less weight to new information. There are pros and cons to both of these approaches but conservatism bias is the process by which we tend to ignore new evidence and this can have an impact on betting and gambling over time.

Conservativism is by definition to keep something safe and stable, effectively reducing risk by taking a path that is well travelled and you know well. This can be a good strategy in many instances but can result in people ignoring critical new details that could significantly change the outcome. Conservatism in betting can actually result in you taking more risks than you would if you properly weighted new evidence.

The Disposition Effect

Humans have evolved to be loss averse, to feel the pain of a loss more than an equivalent gain. This makes a lot of sense as loses can be costly, especially if your life is threatened. As humans have organised into civilised societies this bias has however remained and still persists in decision making around finance and gambling today.

The disposition effect is, in essence, the process of giving up on a winning position too early (e.g selling a rising stock or cashing in a winning bet) while also clinging on to losing positions (such as falling stock or a losing bet). While this is a natural tendency if you can recognise it and avoid it when unnecessary it can be beneficial.

Herd Mentality

Herd mentality, pack / mob mentality or the bandwagon effect, are all different names for the process of following the crowd. It is one of the more obvious biases we suffer from yet it is one of the hardest to avoid at the same time.

We've all done something in the past because other people are doing it, often against our better judgement. Humans are after all social animals and we are hardwired to operate in groups. The problem is that following the herd can often mean we ignore our own beliefs, knowledge or intuition and can result in poor decision making.

The effects of herd mentality in finance are well documented, resulting in numerous financial crashes from the dot-com bubble to bitcoin. There are, however, a lot of parallels between finance and gambling and if you always follow the herd when you bet it can result in poor value and more loses in the longer term.

Ritualistic Behaviours And Superstitions

It is doubtful anyone on this earth is not subject to some sort of superstitious or ritualistic behaviour. These behaviours have evolved as a means for humans to try and make sense of a world we do not fully understand and certainly in the past many superstitions were given credence before modern science helped us discover how things actually work.

Superstitious behaviours can be endearing but they can also be damaging, especially when people have a genuine belief that going through a ritual will have a real world affect on an outcome. This is, therefore, pertinent to betting and gambling where ritualistic practices can lead people to believe they can have an influence on an outcome. This can also lead to gambling problems in the long run.

Positive Moods Can Increase Risk Taking

Positive moods in general increase risk taking and negative moods tend to make people more conservative. This has a clear effect on people when they gamble, with those in a positive mood more likely to gamble and therefore more likely to take a risk - although not necessarily more likely to place riskier bets. Indeed, studies have shown that whole populations can be affected by positive mood influencers, such as good weather, with gambling increasing as a whole within a city when it is in a good mood.

It isn't quite as simple as that, though, as gambling in itself can be responsible for good and bad moods that can then create a feedback loop. Of course, everyone is different and reacts to their moods in different ways but ultimately when betting if we can take our mindset out of the equation and focus on the objective aspects of gambling we can ensure more consistent success.

Commitment Effect

The commitment effect is something anyone can identify with whether they gamble or not, it is the simple process of sticking with something or even increasing our investment into something we have already committed to. This is a common issue in relationships, finances and life decisions but has an obvious impact on betting too.

Studies have shown that people believe a selection is more likely to win after they have backed it than before, this is because they have made a commitment to the bet and that in itself can make people believe it is more likely to win. Often even if evidence shows we may have made a poor decision we can ignore this because we have already committed to it.

Loss Aversion

For much of human history we were very worried about our survival, where our next meal may come from, who may attack us, etc. Therefore, it is no surprise that humans, and animals in general, have a tendency to be loss averse, this is where the pain from a loss outweighs the pleasure we get from an equivalent gain. In effect this is risk management, trying to ensure we win little and often but don't take risks that that could threaten our survival.

Human societies have moved on but that mindset still persists in many. The result of this is many people are predisposed to win as opposed to win money. This presents an obvious conundrum in betting and gambling and it means that a lot of punters and players who are loss averse can win often but ultimately still lose money. Whether it is always backing the favourite or placing lots of small bets on a casino table, while this may mean we win a lot it doesn't necessarily mean we will walk away with more than we started with.

Uncertainty Can Be Its Own Reward

We know from other articles in this section that humans are generally risk-averse and often the pain of a loss is more powerful than an equivalent gain. On that basis then you would assume that people favour certainty over uncertainty and that is true in a lot of situations. However, when some people gamble it is actually the uncertainty itself that can be its own reward, often more so than actually winning.

Uncertainty creates a buzz in some people, or more scientifically a release of dopamine, this gives a sense of enjoyment to a situation, raises the heart beat, etc. This process for some is what they actually enjoy about gambling and they are less concerned (at least sub-consciously) with winning. Uncertainty is, however, risk and taking unnecessary risks when betting rarely ends up well. It can also lead to addiction. The key is to find ways to enjoy betting but also while mitigating the uncertainty (risk). Any professional gambler is not concerned about getting a buzz from uncertainty, to them getting as close to certain as possible is the game.

Dealing With Randomness

Many betting markets and most casino games are subject to or based on randomness and random factors. This makes sense as we want games to be fair and using randomness is widely accepted as the best way to do that. The issue, however, is humans are not very good at comprehending randomness and there is a natural tendency to try to find patterns. This can lead people into making mistakes, for example, thinking that red is more likely to come up than black on a roulette tables simply because the last 6 results were black numbers.

Here we look at what randomness is, why we struggle with it and how to deal with it when it comes to betting. Random factors can cause us to lose but that doesn't mean the bets we placed were not the right ones, as long as you are finding positive expected value then in the long term randomness will cause all markets and games to revert to the average. The trick is to not let your mind convince you of a pattern when none exists.

Take Responsibility For Your Own Bets

Whether you are a gambler that studies their bets for hours or you are someone that bets solely on intuition it is always important that you take responsibility for your own bets. Those that believe that fate, superstitions or others outside factors can influence their bets and choices are effectively more likely to keep making mistakes and that can lead to losses or even worse a gambling problem.

As we are always told in life you need to take responsibility for your own actions and that is true for betting too. Betting is inherently risky, that's why a lot of people enjoy it, but we have to accept that those risks are ours to take and the results of them are ours to deal with.

How Casino Games Are Designed To Deceive

If you sit down with most players who frequent casinos or play online and explain the true hard facts that the house always wins in the end and that really you are just buying entertainment with the hope of winning; then many people would choose not to play. Of course casinos deceive us into playing games, just like supermarkets use tricks to get us to buy things, it makes good business sense.

Everything about a game has been designed meticulously to make it as appealing as it can be, including all the lights, flashes and sounds, all carefully tailored to exploit human cognitive biases. Most people accept that is part of the entertainment, though, but there are other tricks casinos use to deceive, online and offline, that are a little more underhand. Such as, making it seem like we've won when we may not have even won our stake back. Giving the impression of winning without actually winning.

Social And Peer Pressure In Gambling

"Don't allow yourself to be swayed by peer-pressure" we are all told from a young age but that is a strange thing to say in many ways because humans are social animals and we are heavily influenced by what others say and do, especially our friends.

Many of us have been in the position where we have placed a wager or bet more than we want to because we are influenced by our friends, whether that be in the real world in a pub or at a race track or through online social media groups. This, unfortunately, is one of the most common ways that people can end up with more serious issues with gambling and possible addiction. Here we look into the effects of peer-pressure in gambling and ultimately how to avoid it.

Are Humans Rational When Betting? Is Gambling Irrational?

Humans stand out in the animal kingdom for the very fact that we can use rational thinking and logic to make decisions. Still, just because we are able to think rationally does not mean that we always do and there are countless examples of humans thinking irrationally in all walks of life.

Gambling is something that many people do for enjoyment, it is the feeling of anticipation and not knowing the outcome that makes many people bet in the first place. This, however, can also mean that people make irrational decisions when they gamble.

Gambling is not inherently irrational but it does tend to bring out irrational thinking in many. Especially those that get swept up in the moment and make gut decisions. Here we look at rationality in humans when it comes to betting and gambling.

Compensational Betting & Emotional Hedging

Hedging your bets is a process of minimising potential loses by backing the opposite outcome to what you are invested in. It is very common in financial and betting markets as a means to mitigate risk. Emotional hedging is similar except we are not hedging financially here we backing the opposite outcome to what we want to minimise the pain of a negative result.

For example, many people choose to bet against their football team. They want their team to win but at the same time they want to reduce the pain they feel if they lose as they will at least win a bet. Emotional hedging is not a viable strategy to get value from betting but it depends why you bet. If you accept you are likely to lose more money than you win but the emotional pain this offsets is worth it to you then that in itself can be its own reward. By association it also reduces the negative effects of losing a bet as you ultimately saw your team win.

Ratio Bias

Humans evolved to be able to deal with relatively small numbers of things, once we start getting into the hundreds and thousands, let alone millions, we find it very difficult to comprehend those numbers. This is where ratio bias can come in when betting. People are more likely to accept poor odds if the absolute numbers are high vs when they are low. For example, many are happy to play the lottery with odds of 1 in 45 million or the Euro Millions with odds of 1 in 140 million.

It is hard to objectively view big odds and large ratios and it can mean people easily lose sight of the actual probabilities, instead focusing on the big numbers that they could win. Thinking about your bets in terms of ratios and selecting the best value is often a better strategy than just looking at the big numbers alone.

The Ambiguity Effect

The ambiguity effect is linked to loss aversion and it is the process whereby people will often opt for an outcome where they know more information than another, even if that outcome is not a good choice. The idea that you may choose to buy one product over another because one product has 3 out of 5 star reviews and the other has no reviews. We accept the mediocre product rather than take the risk on the product with no reviews, despite the fact it could be better.

Gambling is all about taking risks but as humans we are designed to mitigate risks and err on the side of caution. This can mean that people do not make objective decisions when betting and when information is ambiguous we tend to go for the option where we know something than nothing at all, even if that option is less likely to win.

Preference For Likely Outcomes

One of the biggest biases we keep coming back to in this section is loss aversion. One manifestation of loss aversion is for people to back likely outcomes that have a strong chance of winning but may not actually offer betting value. Backing the favourite will mean you win a lot of bets but more often than not the favourite is poorly priced, meaning if you always back them you stand to lose over time, even though you will win a lot of individual bets.

Some people like winning individual bets more than they are concerned about winning overall in the long term. Those that bet to try to win overall will generally avoid the likely outcome because this is the market that tends to offer the poorest value. Rather many will turn to outside bets that are less likely to win, but that is not the point, the point is are the odds of the outsider are better than the true odds of it winning. For example, always backing horses at 20/1 where their true odds are closer to 15/1 will mean most bets lose but the ones that win will cover the loses and generate an overall return; on average over a long period of time. It ultimately comes down to why you bet and what you want to get from it.

Cognitive Dissonance

Cognitive dissonance is a process whereby people separate their beliefs from fact. Things like voting for things that would actually make you worse off or not giving up smoking because despite the statistics you believe it wouldn't happen to you. In gambling cognitive dissonance causes us to separate ourselves from reality, such as believing we bet or lose less than we actually do or we are more disciplined than we actually are.

The fact cognitive dissonance exists is why many people continue to place bets or play games for money when in the long run they may be losing, because we become disconnected from the reality of the situation. Indeed, many casinos and slot games actually encourage it by making it confusing as to whether we've actually won or not. Understanding cognitive dissonance and confronting it with actual facts can make us better gamblers or at least help us gamble less.

Is Gambling A Reflection Of Human Nature?

Gambling creates a sense of anticipation and can induce positive emotions when we win, like all things enjoyable it can be addictive, to some people more than others. The question around whether we should be free to gamble as we wish or gambling should be restricted is a never ending one but to what degree are we as humans predisposed to gamble? Is gambling just a reflection of our nature?

Well, gambling as it is commonly referred to is taking a monetary risk but in reality we all gamble on all sorts of thing every day. Whether to eat or drink things that may harm us, cross the road on a red light or indeed, even decide to drive a car. From childhood we are taught to assess risk and reward and make sensible decisions on the best path to take. Gambling for money in many ways is just an extension of this, although of course the risks can be high for those who become addicted.

Psychology Used By Betting Companies

Let's face it in the modern world pretty much all advertisers use psychological techniques to get us to buy their products or use their services and gambling companies are no different. Whether they do it deliberately or because they are trying to understand the customer better, bookies and casinos all try to use psychological triggers to get us to play and keep playing.

Whether that be through advertising, exploiting our inherent issues with understanding randomness, giving us freebies, making losses seem like wins or offering us bets that sound good but are poor value; all the companies do it to various degrees. Ultimately it is not the dissimilar to those that push unhealthy food or get us to buy a new car.

Possibility and Certainty Effects

As humans we find it very hard to be objective, especially when it comes to risk and reward and even more so when money is involved. This means that we tend to over weigh and under weigh different probabilities and this can lead to bad betting decisions.

The certainty effect is the process that happens when the chances of something happening drops and this can make us more risk-averse in the future. The level of the drop is not linear and the reaction people have to it is relative to original probability and the amount it has dropped by. The possibility effect is when we view as tiny chance of winning something as bigger than it actually is. People facing near-certain loss will actually seek out risks, meaning that people will be influenced in their behaviour by what they think is going to happen.

The Gut Feeling: Should You Trust Instincts When Gambling?

Some people will make a lot of decisions based on instincts while others won't allow their gut feeling to influence what their head tells them. When betting and gambling following your gut is generally a bad thing to do. Betting companies have in the past promoted following your instincts in their adverts and that in itself should tell you it is not a sensible thing to do, because their primary objective is to make money from punters.

There are arguments in some scenarios that following a hunch can work for some people but on the whole doing research and understanding true odds and value is a far better long term strategy when betting than following your gut feeling.

Dark Nudges: Disguising Loses As Wins

Nudging in psychology is a process by where people are influenced to behave in a certain way or in the way they make decisions. For example, people being nudged in a positive way to recycle, use bikes or travel less to help save the planet.

Dark nudges, as the name suggests, is the process of influencing people to do or keep doing something that is not always good for them. Many betting companies and games developers use dark nudges to disguise loses as wins or to make you believe you have a greater chance than winning than you actually do.

It's not just gambling companies, all sorts of businesses give us dark nudges to do things we don't want or need to.

Diminishing Marginal Utility

Diminishing marginal utility is simply a clever way of saying the more we do something the less enjoyment we get from it. In essence, if we overconsume a product or service then for every additional unit we don't get the same pleasure or benefit as before. Like eating the first chocolate from a box versus the 20th chocolate.

This obviously applies to gambling as those that gamble regularly or compulsively will tend to gamble more over time, stake more or bet on more obscure things to try to preserve the enjoyment. If we consume things in moderation, like gambling less frequently and only on things we are interested in, then we can preserve enjoyment levels without needing to increase the amount we bet.

Making Quick Decisions When Gambling

For a lot of people gambling is instinctive, we make quick decisions on the fly and often don't think about them too much retrospectively. Gambling after all for many is a leisure pursuit and the idea of doing research and calculating odds value is not something a lot of people do.

Ultimately, though, bookies and casinos rely on the fact that people make quick decisions. They want you to bet without thinking much about the value you are getting. In the long run those that take time to research bets and work out how the odds offered reflect the true chances will generally lose less than those that make gut decisions.

The Loyalty Effect

Loyalty schemes are common in many different sectors. Think about getting stamps for buying coffee or burgers, booking hotels or buying subscriptions, or even just a weekly supermarket shop. If we buy these things anyway then we can often get something for free if we stick with the same brand.

In gambling loyalty programs are nothing new but they have exploded since the rise of online betting. Free bet or free spin clubs are now very common, offering you a free token if you place so many qualifying bets (usually in a week). In gambling, though, loyalty can be a bad thing, it stops us from finding better value and encourages us to bet more or bet more flippantly. For those with addiction issues they can even be one of the most negative aspects of betting online.

Are Humans The Only Animals That Gamble?

When we think of gambling we think of taking a monetary risk to try and win more than we staked. That, however, is a very specific form of gambling that has been created by bookmakers and casinos. In reality we all gamble every day in the way we make decisions, we take risks to try to get rewards, whether that be saving time by picking a different queue in a supermarket or crossing on a red light.

One reason humans like to gamble for money is it is hardwired into our brains. When presented with an opportunity to take a risk for reward many will. Therefore, it stands to reason that many animals would do this too. Indeed, there has been a lot of research in the area and many animals gamble, in fact they are sometimes way better than humans at assessing odds and relative risk - possibly because when animals gamble their life may be on the line.

Binary Bias

There is almost nothing in life that neatly fits into a yes or no or black and white category. The problem we have as humans, though, is we like to take mental shortcuts to make quick decisions, which predisposes us to boil things down to simple black and white answers, known as binary thinking.

Binary bias is something that is very common in betting and gambling. We can very easily convince ourselves something will go one way or the other without considering the grey areas in between. Those that take a more nuanced approach will often find they do better in the long term. Nothing is ever certain but if we are prepared to challenge our binary bias tend to find new opportunities and this can lead to more success.

The Illusion Of Control

The illusion of control is a big psychological factor in gambling and one that even people who think they manage their urges and biases can fall foul of. The problem is when we bet we do so because we have some belief it will win, otherwise what is the point. This can naturally lead people into thinking they have some sort of control over something that is driven by random factors. If that bet then wins we can believe it is because we controlled it in some way rather than it happening through random chance.

In sports there are factors that can give us a greater chance of winning vs fixed odds games but still people have desire for control that can lead them to believe things like superstitious behaviours influenced an event more than the real factors. These issues can be more severe in pathological gamblers.

The Effect Of Near Misses

We all know how hard near misses can be to take. Think about your team finishing second in the league, it feels far worse than finishing mid-table because we think we should have won. The same is true when betting. If we back say a horse to win a race and it comes a close second we can feel like we should have won and that may make us bet more.

Ultimately second place is just the first loser and whether your bet comes second or last the bookie keeps your stake either way. In gaming this is often exploited, with slot games often showing 'near misses' that can make you believe you are close to winning when in reality it is all random. Near misses can induce a dopamine and adrenaline release, the same feeling we get when we win. This is naturally more difficult for problem gamblers.

Illusion Of Knowledge

We've all heard the expression a little knowledge can be a dangerous thing and that is very true in betting and gambling. When we gamble we often overestimate the importance of our own knowledge and beliefs and that can preclude us from looking at other important data and factors that could influence the outcome of a bet.

When we bet and gamble we should objectively look at each situation on its own merits each time, making sure to study the latest data and important factors. People who believe they are experts, e.g. because they are betting on a team they support, can often convince themselves they have more knowledge about things that will happen than they actually do. Avoiding this illusion can be hard but those who are disciplined and constantly re-evaluate their 'knowledge' often do better in the long run.

Representative Heuristic

Humans are really bad at judging probabilities in a lot of situations. We are not too bad at it when things have a fairly even outcome but we are terrible at it when things are either very probable, very unlikely or generally uncertain. Rather than sit down and do research to evaluate the true probabilities we take mental short cuts and often use a 'rule of thumb' to make our decisions. This is the representative heuristic at play.

It is similar to the availability heuristic, where we use outcomes of recent events to make decisions, but pertains more to situations where we judge the probability of something happening when the outcome is uncertain. If you are unsure about the chances of something happening many people will use a rule of thumb. Naturally you can see why this might be a bad thing when evaluating odds and betting markets.

Personal Choice

If you play the same lottery numbers every week and someone came along and offered to swap your ticket for five times worth of lucky dips many would refuse. That is paradoxical given the outcome of the lottery is random, having five times the number of entries is surely better? However, because we chose our own numbers many believe that they are more likely to win, or they will win if they don't play them.

This is an example of where personal choice can distort our view when gambling, it gives people an illusion of control. When someone throws the dice in craps they are more likely to increase their bet on that hand, when in reality they have no more chance of winning than when someone else threw the dice. The only personal choice we have in random games is to bet or not to bet, once we bet the outcome has nothing to do with our choices.

Weighting Probability From Intuition

Humans are pretty good at estimating probabilities when outcomes are near to equal or in defined fractions such as quarters. Where we fall down is when we try to judge probabilities for outcomes that are either very likely or very rate. This has an obvious impact when gambling as we also struggle to weigh up the value of odds using intuition in these instances.

Take the lottery, it is actually a very poor value bet relative to your chances of winning but the chances of winning being millions to one means people cannot judge that easily so often they don't bother, focusing on what they could win as opposed to whether that is a good investment.

Why Do People Gamble If They Know They Will Lose?

There are not many people who gamble who do not understand that the house always wins and the punter pretty much always loses over time. Whether they pull the wool over their eyes to that fact or not the majority know the reality.

The thing is while a lot of people bet to win many do not. Some people gamble purely for entertainment and see loses as part of the 'cost' for that entertainment, accepting they will likely lose but get enjoyment in return. Even most people who bet to win understand they will probably lose and it is the hope that drives them on. If this is done in a controlled and sensible way that is often fine.

Of course, a minority also gamble because it is compulsive even though they know they will probably lose, this is where problem gambling comes in.

How Do Psychologists Treat Gambling Addiction?

We know that by and large gambling is a leisure pursuit that is enjoyed but for a minority it can become addictive and lead to serious problems for them and their loved ones. Psychologists and councillors play a critical role in helping treat addiction and understanding what they do and how they do it can be useful to you if you are suffering problems arising from gambling or you know someone that is.

Professionals in this area use tools such as cognitive behavioural therapy and other therapies that help people identify underlying and associated issues. As with any form of help it is only one part of the solution but for those that need help it can be a very important factor.

Winning Streaks: Skill or Luck?

For fixed odds casino games the odds are always in the favour of the house, meaning while you can win over time most people are almost guaranteed to lose. Winning streaks do happen because of the way probabilities work and you could call this 'luck' but all the skill in the world (other than cheating) can not guarantee you will win long term.

With sports it is a little bit more nuanced in the sense that odds on average are still always in the favour of the bookie but more variables means those with a lot of skill can spot variables that can shift odds into their favour. A disciplined strategy here can on occasion result in some people winning more than they lose, although even here steaks are rare as outcomes are inherently unpredictable.

Role of mathematics in gambling and problem gambling

Gambling is inherently based around mathematics and it is the premise for its existence on a commercial scale. For many people the maths around gambling is boring but for those that call themselves 'professionals' it is an essential part of any game or system.

It is not just players that utilise it either. Games produces, odds traders, operators and regulators all utilise mathematical modelling and analysis, to say it is essential is an understatement. Maths isn't just a tool to measure in gambling; it can also help us diagnose and correct cognitive disorders that predominantly lead to problem gambling.

Asymmetric Outcomes

Humans and animals in general are hardwired to take more risks if the rewards are greater, which makes a lot of sense from a survival point of view. The problem is when it comes to gambling we often take a similar approach when it comes to asymmetric outcomes. We think of spending £2 on a lottery ticket as worth it because we have the chance of winning millions and we don't spend much time thinking about how bad the odds of the game actually are.

People massively overestimate their own chances of winning even when the odds are terrible. Betting companies take advantage of these psychological risk/reward biases and often push games and events with asymmetric outcomes.

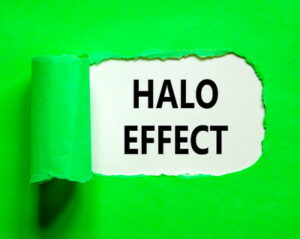

The Halo Effect

The Halo Effect is closely linked to the Availability Bias (which you can also read about on this page). It is a bias that forms based on the order that we receive information and it can cause it to judge something as better or worse when in reality there are no differences. This can have a big effect in gambling as it can influence your assessment of the real chances of a bet actually winning.

Let's take two people as an example, Ben and Mark. Ben is judged to be friendly, intelligent, hardworking, impulsive, critical, selfish, jealous while Mark is judged to be jealous, selfish, critical, impulsive, hardworking, intelligent, friendly. These are exactly the same traits but most people will see Ben as better person than Mark simply based on the order in which information is received.

Anchoring Effect

Retailers constantly try to trick customers into thinking they are getting a good deal by setting a high price before then heavily discounting that price. Think of every advert for a sofa you have ever seen. The idea is the initial price acts as an anchor making the 'discount' appear as though you are getting something very cheap. In reality the sofa was never worth the original price.

Anchoring bias is something that happens all of the time to people. In sports betting you can often see odds for a team or horse winning and this can act as an anchor. If those odds then get shorter later it can make you think that the chances of winning are greater than you thought. If they get longer you may think there is less chance. If you had not seen the previous odds you may not have those thoughts. This is an example of anchoring bias in betting and it can be dangerous as it can impact effective objective decision making.

Diversification When Gambling

People tend to be more diverse in their choices when presented with many options simultaneously compared to sequentially one after another. This is important in gambling because the way in which we are presented information (e.g. available betting markets and odds) can influence how diverse we are with our bets.

Knowing about this factor can mean you can use it to your advantage. People who are more diverse with their bets may gain more enjoyment from betting and it may help to mitigate risk. If done without consideration, though, diversification can give an illusion of control that can be dangerous in other ways.

Obedience To Authority

If Einstein tells us E=mc2 then most us will believe that on face value and we do not go into detailed mathematical proofs to prove it ourselves. This is an obedience to authority. It is common in science but it also transfers to most other aspects of life, including when betting and gambling.

Many people listen to pundits, ex-players / jockeys, tipsters and so called professionals when they bet. It can be useful to hear the opinions of those with close relationships to a sport but many of us put too much faith in those people and this is obedience to authority.

Here we are taking mental shortcuts to make life easier for ourselves but in reality it could mean you are less successful when betting. Listening to those with authority is important but it is only one component and rarely should you invest in what someone else says without thinking about it for yourself.

How Framing Effects Influence Betting Decisions

The way in which we receive information has a big impact on how we interpret and analyse it. All companies know this and so they often frame information in a way that looks more positive to the customer. For example, if you saw two yoghurts and one said 90% fat-free and the other said 10% fat you would choose the first option, despite both of these being the same.

Humans are generally loss averse and so many bets are framed to make the gains look more attractive than the potential loses. The only way to avoid this framing effect is to analyse what you bet on and look at the same information from different perspectives. Only then can you be objective in how you assess information and markets.

The Dangers Of Financial Abstraction

The idea of financial abstraction is that by converting cash, or what we perceive as 'real money' into digital funds or plastic chips can reduce its meaning to most people. Gamblers often behave differently when betting in cash, which isn't very common anymore, versus playing with digital money online or chips in a casino. This can naturally mean people are less risk averse and may be more likely to lose.

With the rise of cryptocurrency too there is now the potential for double abstraction. Here we are using crypto currency, which is already detached from cash being digital asset, and using this to then gamble. For some people this can be a dangerous mix.

Habitual vs Impulsive Gambling

People love tick boxes and we like to categorise things as black or white. If you are asked if you are more of a habitual gambler or an impulsive gambler most would opt for one of the options over the other. It is true that people will be more habitual or impulsive by default but what studies have shown is the state can be fluid. Someone may be a habitual gambler but a change in life circumstances could create impulsive tendencies and vice versa. This is often where many problems start out.

Here we look at what impulsive and habitual gambling is and what drives these tendencies. We also look at how these can change and the effects of the always available online gambling boom on both behaviours.

Psychology of Gambling Warnings

Gambling warnings have been around for a long time now but many think they do not work well enough. This isn't because they are not created with the best of intentions.

Many people stop noticing warnings after they have seen them a few times, becoming null to the message. Even worse it can actually induce some people to gamble more and the messages themselves can become counterproductive.

What research has shown is that we are all different and we all gamble for different reasons. Warnings need to be personalised to us to be noticeable.