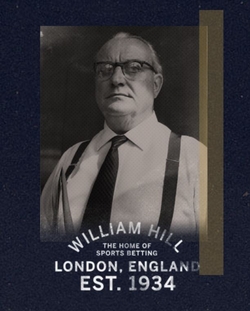

The man behind the brand, Mr William Hill himself, started taking bets as early as 1929, but it was in 1966 that he opened his first licensed betting shop.

The man behind the brand, Mr William Hill himself, started taking bets as early as 1929, but it was in 1966 that he opened his first licensed betting shop.

This led to the exponential growth of the famous high street bookie that we see on the streets of the UK today, as through various buyouts of smaller bookmakers Hill’s retail portfolio grew to giant proportions.

These days the company is multi-national, and relies as heavily on online business as it does on the traditional retail side of things, with ambitions to take this much further in the future.

The purchase of Mr Green online casino is a case in point. Having previously adopted a growth strategy of acquiring physical businesses they could rebrand as William Hill, Mr Green represents the first acquisition made based on the strength of the brand itself.

However, any plans the company had to continue in this way have been shelved.

Their recent takeover by Caesars, who sold the European assets to 888, means that William Hill is now at a turning point in its’ history. It is no longer in control of its own destiny, now being a brand that is part of a larger group rather than a brand being run independently.

William Hill Brands

Company Details

You can appreciate the global scale of the company when looking at the office locations in the table above. The brand are actually big in America too, but the US elements are owned by Caesars Entertainment and are in no way connected to the brand in the UK other than in name.

William Hill’s recent aim was to become more profitable through the online side of the business as this is understandably much easier to set up across the various different regions and jurisdictions, however, their acquisition by 888 will heavily impact what they do next.

This is because William Hill are no longer acting simply for their own benefit, their aims and strategies need to fit in with those of a wider group of brands.

William Hill’s appetite for acquisitions may lessen now they are part of 888 Holdings too. They used to take over smaller bookmakers in other regions then rebrand them as William Hill. BetAlfa in Colombia is an example of this; they informed customers that BetAlfa was changing… and it did, into William Hill. This kept Hill’s mostly a single brand business, but now it is part of a group it may well be them making the acquisitions and William Hill being kept in their box.

Mergers and Acquisitions

Acquisitions for Australian Expansion

With global expansion the focus of the company, Hill’s shelled out £459.4 million for Sportingbet’s Australian division, with a call option over their Spanish business included.

This would give them a heavy footprint in the Australian market, one of the biggest regulated markets in the world, as Sportingbet were one of the best known sports betting brands in the country.

Then in August, TomWaterhouse.com was purchased for a more modest A$34 million upfront in cash, further strengthening the group’s Australian position.

Both were brought under the William Hill brand.

William Hill Australia Offloaded to CrownBet

William Hill’s 5 year dalliance with Australia came to an unsuccessful end when CrownBet, part of the Stars Group (TSG), took it off their hands for A$314 million.

Their attempts at conquering the lucrative Australian market pushed Hill’s to their first pre-tax loss in three years the year previous, and their focus had now switched firmly to the US.

What’s more, Australia was going through a period of regulation tightening at the time, which would further hinder the group’s profitability there.

Mr Green Joins William Hill

Costing them a smooth £245 million, the online casino Mr Green was purchased with a view to expanding Hill’s online interests in Europe.

The brand was strong and already well known in many countries, so the purchase price seemed like a bargain given that it was expected to be covered in the first year of ownership, not to mention the synergy benefits.

Interestingly, this is the only acquisition that William Hill has made where the brand was left alone – Mr Green still operates as such.

CG Technology Acquisition Boosts US Footprint

Although already well established in Nevada, the purchase of CG Technology, a sportsbook solutions provider, allowed William Hill to take charge of four further sports betting properties on the Las Vegas strip.

This was at a time when the global gambling industry was scrambling to get as much of a footprint as possible in the US after the laws on sports betting were changed, opening a huge new potential market.

The financial details were not made public.

Caesars Entertainment Make a Move for William Hill

Although the deal was agreed in September, it wasn’t until November that the official shareholder vote confirmed that Caesars Entertainment would be acquiring William Hill and all of its associated business interests.

However, the deal would also see the business split up, with further buyers being sought for the UK side eventually.

Hill’s and Caesar’s were already doing business together, but this deal would allow them to bring all of their different income streams under one umbrella, which in turn would make it easier to roll out across the US as and when new states open up for online sports betting.

888 Purchase William Hill’s European Assets

Not even a year after the sale to Caesars was agreed, 888 had snapped up the UK and European side of the business in an effort to quickly expand and gain market share in the sports betting world.

They paid £2.2 billion for the privilege, meaning Caesar’s reclaimed the vast majority of the £2.9 billion they paid for the entire business.

This deal meant that William Hill was now effectively one brand but two different companies, with little to no link between them save for the name.

It is yet to be seen how this will play out.

About the Business

Far from taking the multi brand approach employed by the likes of Entain and the Kindred Group, William Hill has historically always acquired businesses that could be swallowed up by the existing brand.

Far from taking the multi brand approach employed by the likes of Entain and the Kindred Group, William Hill has historically always acquired businesses that could be swallowed up by the existing brand.

This meant amassing physical betting shops in the beginning, and for a while they had upwards of 2,000 bookies in the UK, but as the digital age dawned they could also acquire tech companies and bring them in house too.

This single brand approach has made the name William Hill famous throughout the world, but the business itself operates as three distinct divisions albeit under the same umbrella.

Or at least they did until the sale to Caesar’s.

They were:

- Retail – UK

- Online – UK and Europe

- US – Retail and Online

Now, Hills slot into two of 888’s divisions, UK and Ireland Online, and Retail.

As of 2022, 81.78% of their net revenue came from the UK, with just 18.22% drip feeding in from other international territories.

When you consider that they are licensed in 12 countries and operate across 100+ markets this explains why they were keen to diversify and not rely so heavily on the UK going forward, but if you look at the previous years figures international revenues had actually decreased.

With 888 now at the helm, and with a strategy of their own, William Hill are now part of bigger plan rather than being the ones making the plans for themselves, so this may not be so much of a problem.

Their history as a brick and mortar bookie is still an important part of 888’s strategy – 888 wouldn’t have bought the company if it wasn’t – and in fact retail revenue rose to £514.2 million in 2022, 52.7% up year-on-year, while their online revenue actually dipped by 19% to £509 million. William Hill pulled in another £212 million internationally.

This means that for 2022, retail revenue made up 41.62% of the total while online revenue made up 41.20%. International trade picked up the remaining 17.16%.

These figures were impacted by a return to retail betting after lockdowns, William Hill exiting the Dutch online market, and enhanced online checks in the UK pushing some customers away, so they may not be that representative of the long term picture for Hills.

This retail exposure is excellent diversification for 888 Holdings though, and simultaneously gives them a huge footprint in the UK sports betting market.

That said, William Hill have historically enjoyed a fairly even split between their sports betting and online gaming products, taking 60% revenue from sports betting vs 40% gaming in their retail division, and 60% gaming vs 40% sports betting online in 2020.

Going forward, the company aim to become a digitally led and internationally diverse business, with their recently remodelled retail division maintaining its popularity in the regions where it operates.

History

William Hill was born in Birmingham in 1903, and began collecting illegal bets from an early age on his motorcycle. Then at 16 he joined the Royal Irish Constabulary which took him across to the Emerald Isle until 1929 when he moved to London.

William Hill was born in Birmingham in 1903, and began collecting illegal bets from an early age on his motorcycle. Then at 16 he joined the Royal Irish Constabulary which took him across to the Emerald Isle until 1929 when he moved to London.

This was where the business really started, although initially it was an illicit gambling den opened in 1934 that took advantage of a loophole in the law allowing credit and postal betting but not cash. Off course gambling in the sense that we know it now was still illegal at this point.

The law changed in 1960, but the first William Hill betting shop didn’t open until 6 years later, with Hill being dead against them to begin with.

Acquisitions started almost immediately, and have continued to be a major growth driver for the company until this day, and so the company’s portfolio of shops began to accumulate.

William Hill himself died in 1971, just a year after retiring, and the company was now owned by Sears Holdings Group, but a series of acquisitions was to follow with the Hill’s business being sold on several times:

- Sears Holdings Group – 1971-1988

- Grand Metropolitan – 1988-1989

- Brent Walker – 1989-1997

- Nomura – 1997-1999

- Cinven & CVC Partners – 1999-2003

The company actually launched on the London Stock Exchange in 2002 but Cinven didn’t sell their final shares until a year later.

William Hill was already online by this point having launched a sports betting website in 1998 with a casino following in 2000, so they were ready for the online boom which would follow.

Their success in the online space over the next two decades and their ambition to expand globally led them to dealings with Caesars Entertainment who, in 2020, became the latest company to buy William Hill.

UK Tax and Contributions

Since William Hill are so prevalent in the UK space, they contribute heavily to the country and in a number of ways too.

Since William Hill are so prevalent in the UK space, they contribute heavily to the country and in a number of ways too.

Tax and gambling duties are the most obvious, and with over £1 billion in revenue from the UK that tax bill is going to be significant. There was £290 million going into the pockets of HMRC in 2020, so it will be a similar amount in 2022, but tax only tells part of the story.

William Hill employ around 10,000 people in the UK, whether they be office staff or retail workers, and this workforce represents one of their biggest expenses at £236.5 million – this is all money that those workers will then be taxed for and then go on to spend in the economy.

Then there is the money attributed to property payments, so shop and office rent, not forgetting the huge amount of sponsorship that William Hill take part in. They spent £151 million on marketing in 2022, so if we roughly guess that the amount spent here was proportional to the amount earned here, around 80%, that’s another £120 million pumped into the economy through football clubs, horse racing tracks, and more.

Then there is the £40.2 million in interest paid to UK banks, money paid out as dividends to UK shareholders of 888, spends on sundry from the shops and offices, etc. All these little things add up.

Lastly, like most other large companies, William Hill donate to charity both financially, and by giving their time. Employees will be granted volunteer days and have worked at Greyhound rehoming centres, for instance, giving back in a number of ways that keeps the UK economy bubbling away.