Casinos were one of the first examples of industrialised gambling, if you want to call it that, with a story going back to 1638.

Casinos were one of the first examples of industrialised gambling, if you want to call it that, with a story going back to 1638.

A theatre called the Saint Moses in Venice, built an area for the audience gamble in during the interval of the performance, and the idea caught on sparking a sort of casino craze. By 1744 there were 120 casinos in Venice alone.

That casino is still in business by the way, now called the Casino di Venezia. The theatre is not.

What does that tell you?

This brief unrequested history lesson is a long-winded way of saying that the casino industry has developed a lot since it first began, and the latest UKGC data gives deep insights into how it is changing now, and where things might go in the future.

The rise in online casinos (and online everything else for that matter), seems to be making us more solitary creatures, and even when we do go to a high street casino, more of us are choosing to sit alone at a gaming machine rather than join a blackjack, poker, or roulette table.

So while the gross gambling yield in the casino industry is going up, more and more of it is coming from the same place, and that’s probably not great for innovation and variety in the long term.

Casino Industry Revenues

Within the gambling industry, the casino sector has seen revenues increase every year since 2015 except for 2020, when covid struck. Even then, however, the combined total revenues of remote and non-remote casinos was a mere £100 million short of the previous year.

This is largely due to the growth of online casinos though, as high street casinos have struggled to make any progress in this time, and indeed, saw the gross gambling yield fall from 2017/18 onwards.

If we take the GGY from both online and offline casinos and add them together, we get the GGY for the sector as a whole:

- 2015/16 – £3.363 billion

- 2016/17 – £3.825 billion

- 2017/18 – £4.112 billion

- 2018/19 – £4.167 billion

- 2019/20 – £4.250 billion

- 2020/21 – £4.156 billion

- 2021/22 – £4.590 billion

- 2022/23 – £4.848 billion

While this shows a steady healthy-looking growth pattern, the online and offline casino worlds are actually doing two completely different things.

What is happening, is the online casino revenues are covering for the decline in high street casino revenues.

Put simply, people are gambling at home rather than in person.

Falling Revenues Not Significantly Impacting Venue Numbers – Yet…

Despite the falling revenues of non-remote casinos, closures have been relatively rare.

Despite the falling revenues of non-remote casinos, closures have been relatively rare.

The 2023 figures show 144 high street casinos operating in the UK, down around 8% from 156 in 2020.

This is clearly down to the impact of covid and the slow recovery afterwards, but it’s actually the same number of active venues as back in 2013, and a few more than 2008 and 2009.

Plus, the casinos we lost have been either independents like the Broadway in Birmingham and the Shaftesbury in West Bromwich, both owned by Clockfair Ltd who went into administration; or smaller venues run by big companies, like the Cornerhouse in Nottingham, owned by Genting.

To me, this says that the bigger destination venues that feel a bit more grand and are better suited to a special night out are doing ok, but the smaller venues that are less of a draw for large groups and might rely more on passing trade are struggling.

Equally, smaller companies are less well equipped to survive the cost-of-living crisis after battling through covid and lockdown, so while the Gentings and Grosvenors of the world can close a few loss-making venues to balance the books, companies with either a single venue or a small handful of venues are in greater danger of failing completely – but there aren’t many of them anyway.

The number of casinos in the UK has been bobbing between 141 and 156 for decades, and before covid they were at their highest number in years, so I think we will get back to that.

This is provided the post-covid recovery continues of course, and the cost-of-living crisis has slowed that down.

If, over time, we see further declines in non-remote casino revenues, then we will surely see further closures, but for now, they seem to be able to weather the hard times for the most part.

What are the Most/Least Popular Games at Casinos?

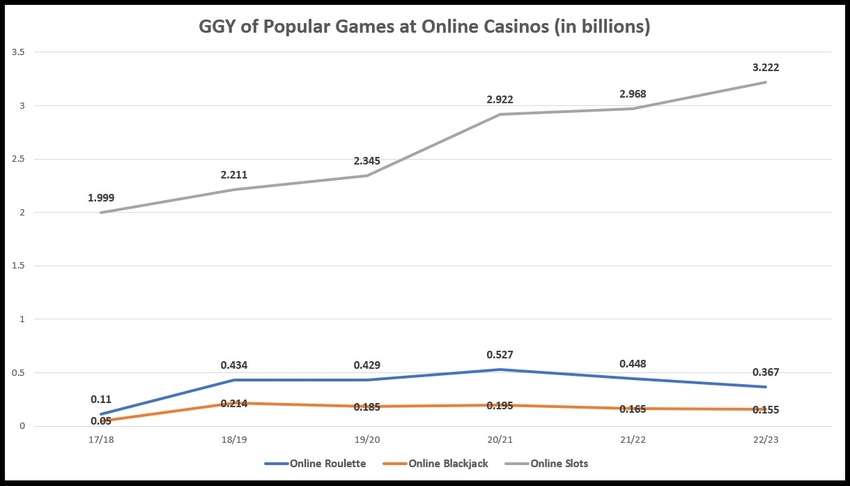

It’s clear to see that slots, which were responsible for 79.81% of revenues in 2023, are far and away the most popular game type at online casinos, and that will be covered in more detail shortly.

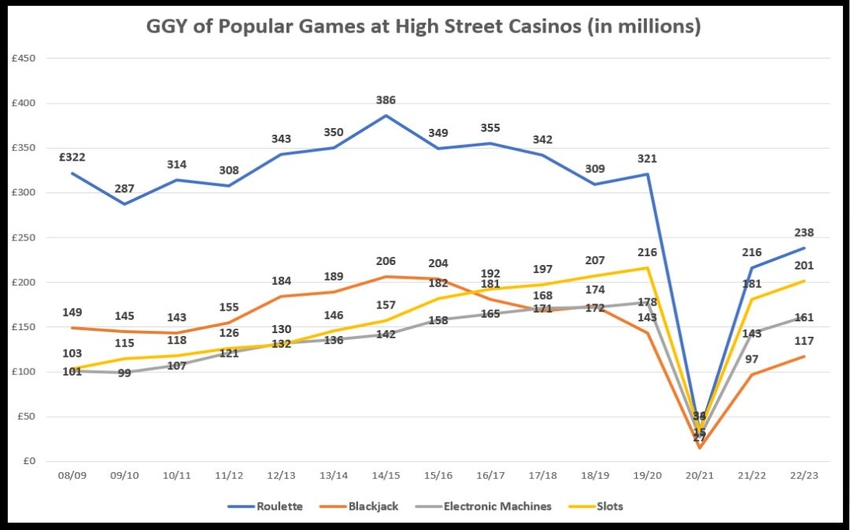

However, the use of gaming machines in high street casinos is on the rise too, while roulette and blackjack are also predictably popular in brick-and-mortar venues, accounting for 29.37% and 14.46% of non-remote casino revenues respectively in 2023.

Games that don’t tend to get as much coverage though, are the likes of Dice, Poker, and Punto Banco.

These, let’s call them fringe games, are not as widely available – the only time I’ve ever seen a craps table was in Atlantic City, I’ve never seen one in the UK, probably because there are only 8 craps tables in the whole country – and it seems like brick-and-mortar casinos are removing them in favour of games that are more popular and more profitable.

Here is the annual revenue earned from each ‘fringe’ game type since 2008/09 until 2023, along with what percentage that equates to when looking at the overall annual GGY of non-remote casinos:

| Annual GGY £ and % | Punto Banco | 3 Card Poker | Dice |

|---|---|---|---|

| 08/09 Revenue | £67 million | £38 million | £4 million |

| 08/09 % Revenue | 9.7% | 5.46% | 0.51% |

| 09/10 Revenue | £55 million | £36 million | £3 million |

| 09/10 % Revenue | 8.64% | 5.65% | 0.41% |

| 10/11 Revenue | £59 million | £37 million | £3 million |

| 10/11 % Revenue | 8.71% | 5.47% | 0.44% |

| 11/12 Revenue | £98 million | £44 million | £7 million |

| 11/12 % Revenue | 13.23% | 5.94% | 0.99% |

| 12/13 Revenue | £106 million | £49 million | £3 million |

| 12/13 % Revenue | 12.8% | 5.99% | 0.36% |

| 13/14 Revenue | £220 million | £50 million | £0.44 million |

| 13/14 % Revenue | 23% | 5.22% | 0.04% |

| 14/15 Revenue | £195 million | £49 million | £2 million |

| 14/15 % Revenue | 19.68% | 4.91% | 0.23% |

| 15/16 Revenue | £23 million | £56 million | £3 million |

| 15/16 % Revenue | 2.9% | 7.02% | 0.37% |

| 16/17 Revenue | £186 million | £60 million | £3 million |

| 16/17 % Revenue | 19.46% | 6.22% | 0.29% |

| 17/18 Revenue | £231 million | £57 million | £3 million |

| 17/18 % Revenue | 23.72% | 5.9% | 0.33% |

| 18/19 Revenue | £133 million | £61 million | £3 million |

| 18/19 % Revenue | 15.63% | 7.22% | 0.34% |

| 19/20 Revenue | £110 million | £61 million | £3 million |

| 19/20 % Revenue | 13.66% | 6.46% | 0.28% |

| 20/21 Revenue | £3 million | £3 million | £0.06 million |

| 20/21 % Revenue | 4.16% | 3.71% | 0.04% |

| 21/22 Revenue | £26 million | £27 million | £0.89 million |

| 21/22 % Revenue | 5.03% | 5.19% | 0.17% |

| 22/23 Revenue | £49 million | £40 million | £0.81 million |

| 22/23 % Revenue | 6.04% | 6.05% | 0.09% |

Punto Banco has had a pretty wild ride as you can see, with huge spikes in popularity that I can’t explain – maybe there was some sort of reporting error – but it has been trending down since 2017.

3 Card Poker has had a steadier ride, but there is no long-term trend to be found, indicating (to me at least) that the game has a core group of players who enjoy it and will come back to it regardless.

Lastly, Dice have never made much money for casinos, but again, the trend is definitely down on a percentage of GGY basis, and that was true even before covid hit.

But even the more popular traditional casino games aren’t earning the same sort of money as they used to, not compared to the overall gross gambling yield.

Table Games Falling Out of Favour

Back in the day, if you went to a casino then it was to play against other people and/or the dealer, not to sit at a machine – there was a time when casinos didn’t even have gaming machines.

But gaming machines are becoming the first choice for many players, as traditional casino games fall out of favour.

Look at the graph below, and you can see that the only game types with a steady upwards trajectory are slots and electronic machines – so video poker or electronic roulette etc.

This trend pre-dates covid too, so although the pandemic exacerbated things, it is not the cause.

As of 2018, both slots and electronic gaming machines had actually overtaken blackjack in terms of GGY, and it has stayed that way ever since, meaning that only roulette brings in more money for high street casinos.

The gap between blackjack and gaming machines is widening too, with the machines taking around 23% more money pre-covid, and about 37% more money post covid. With slots it’s even wider.

At the same time, roulette’s revenue is dropping. While roulette took 81% more than gaming machines in revenue pre-covid, that figure is down to 47% as of 2023, and they only take around 18% more than slots.

So even the most popular casino game, Roulette, is on a downward trend in terms of gross gambling yield.

I found this odd because whenever I visit a casino I tend to see busy roulette tables, but perhaps the amount people are wagering is decreasing, or they are spending less time at the table than before. I definitely notice people coming in to use the machines, then leaving half an hour later too, so it could be that the majority of the growth is from this type of customer.

This is why, harking back to the casino closures, I think that the bigger casinos are going to be alright. They attract the 30-minute slot session customers, as well as the lad’s night out type customers who will spend all evening there and try blackjack and roulette as well as the machines. Those smaller casinos are less appealing for a big night out, and seem closer to adult gaming centres such as Admirals and the like, so they don’t attract the same mix of customers but cost a lot more to run.

This trend for slot machines over table games is even more pronounced with online casinos, although you would expect as much given that the online experience of traditional casino games is not a patch on the real thing, and given that the number of online slots available massively outweighs any other game type.

Still, the actual figures are quite astounding:

The UKGC started recording the data in a different way as of the 2017/18 financial year, which is why this graph starts there.

They previously lumped blackjack and roulette etc in together as ‘table games’ which royally screws up the data, but if I tell you that online slots revenues went from £1.559 billion in 2015/16 to £1.773 billion in 2016/17 (an annual increase of 14%), then you can see the trend was already gathering pace.

The revenues from online slots since 2016 have increased 11.6% year on year on average, with a huge 25% jump during lockdown that plateaued in 2022 before taking off again in 2023.

In the same time period, online blackjack is actually taking 16% less than it was in 2019, while roulette is taking 14% less than it was in 2019, although roulette revenues have gone up as well as down within that time.

What Does This Data Mean for the Future of Remote and Non-Remote Casinos?

Personally, I can see the casino landscape becoming far less interesting.

Operators and game developers will create more of what sells, so if people are shifting more towards super simple games with a quick-fire nature, that’s what they will create.

This could trigger a sort of doom spiral where a lack of options pushes players towards specific types of games, which the operators then see as the market moving away from alternative games, so they offer even less diversity to meet what they think the customers want, and so the cycle continues.

I can’t see traditional table games dying out completely or anything drastic like that, but equally, I don’t foresee high street casinos integrating more craps tables or other more niche games.

UK high street casinos are already fairly basic compared to their US counterparts, usually offering blackjack, roulette, and maybe a poker variant or two, and I don’t imagine that will change. Things are much more interesting in the States.

Online casinos are a little bit different because it is not as costly for operators to include a more diverse selection of games, but I have already noticed that most casinos have a list of slots numbering into the thousands, with little else being pushed on the homepage.

This is clearly where they make the most money, even without the data to back it up.

Yet online casinos know that there is a market for alternative games, albeit a smaller one, so as long as the revenues outweigh the costs of providing them, they will probably stick around.

Live casinos is where the most innovation seems to be happening in my experience, although not within the traditional casino game space, more within the gameshow type games, which again, speak to those who prefer the simple nature of slots.

As I explained on the main UKGC data page, I think there are fewer and fewer people who want to test their skills in a casino, and more who simply want to try their luck.