The Covid pandemic and lockdown had a dramatic effect on every aspect of our daily lives, and on every business too.

The Covid pandemic and lockdown had a dramatic effect on every aspect of our daily lives, and on every business too.

Almost all sporting competitions were suspended at least for a short time, so bookmakers were unable to offer their usual range of markets because there was simply not much left to bet on.

Horse racing was completely suspended for a time, and although it did open up again behind closed doors fairly quickly, the impact of Covid was felt throughout the industry.

When horse racing punters were able to bet again, bookies had to work harder to win their business, and desperate to make up for their losses, they dropped their margin in order to offer more attractive odds.

This reduced margin is good news for bettors, but the truth is that bookies have been reducing their margins steadily since the mid-90s.

Margins remained low post Covid too, and indeed kept heading downward, so is it the case that Covid forced the bookies’ hand and started a new era of ultra-low margins on horse racing?

There’s a little more to dig into here.

Bookie Margins on Horse Racing Before Covid

Between 2015 and 2019, the bookmakers had been steadily increasing their margins on horse racing after several years of trundling along at an average of around 15%.

The global financial crash in 2008 caused a significant dip in margins as bookmakers had to adapt to a world where people had less money to spend, and it took a good 7 years before they felt they could start cranking them back up again.

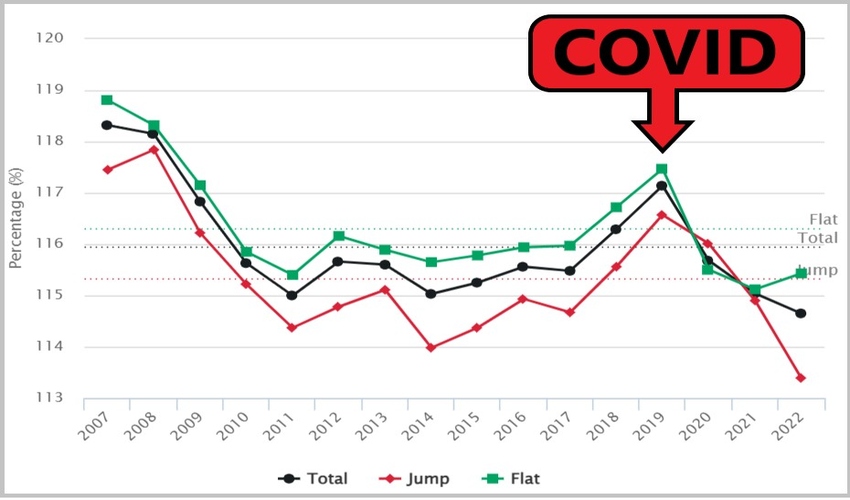

Here is a chart showing the various changes in the bookies margin between 2008 and 2019:

| Year | Total | Jump | Flat |

|---|---|---|---|

| 2019 | 117.14% | 116.57% | 117.47% |

| 2018 | 116.29% | 115.56% | 116.72% |

| 2017 | 115.48% | 114.67% | 115.97% |

| 2016 | 115.56% | 114.93% | 115.94% |

| 2015 | 115.25% | 114.37% | 115.78% |

| 2014 | 115.03% | 113.98% | 115.65% |

| 2013 | 115.6% | 115.11% | 115.89% |

| 2012 | 115.66% | 114.78% | 116.16% |

| 2011 | 115% | 114.37% | 115.4% |

| 2010 | 115.63% | 115.22% | 115.85% |

| 2009 | 116.83% | 116.22% | 117.15% |

| 2008 | 118.15% | 117.84% | 118.32% |

As you can see, the average margin on horse racing across both racing disciplines (jumps and flat) in 2015 was 15.25%, climbing to 17.14% by 2019. The average margin climbed every year in between except for 2017, but it only went from 17.56% to 17.48% – a drop of just 0.08%.

This is still some way off the highest average margin on record, which was 22.73% in 2001, but the bookies clearly thought they could edge things back in that direction without scaring off the punters.

Bookmakers have to follow the economic mood of the country if they want to keep their customers, as we discussed in our more general article on margins and overrounds here, so when Covid came along, they were bound to react in a similar way.

Incidentally, if you want to learn more about margins in general, such as how to work them out, read this article.

Bookie Margins on Horse Racing After Covid

The impact Covid had on horse racing wasn’t confined to the sport itself, but to the people who bet on it.

Yes, it was harder to travel horses to different races, and yes races were cancelled for a while, but the punters had similar problems with travel due to the lockdown (racing was behind closed doors after initially reopening), and many had less money to spend.

There was quite a lot of financial help during the lockdowns but it didn’t cover everybody, and those who were getting financial help didn’t know how long it would last, so bettors were more cautious and bookies had to be sensitive to this.

If you look at the chart below, you can see what happened to average margins on horse racing from 2019 to 2022, which obviously covers the 2020 pandemic and recovery:

| Year | Total | Jump | Flat |

|---|---|---|---|

| 2022 | 114.65% | 113.39% | 115.43% |

| 2021 | 115.04% | 114.9% | 115.12% |

| 2020 | 115.68% | 116.01% | 115.5% |

| 2019 | 117.14% | 116.57% | 117.47% |

Just as margins were beginning to increase, they dropped again, and then continued to drop even into 2022 after Covid had been forgotten.

Of course, there were other things going on in the UK at this time, such as the effects of Brexit and a cost-of-living crisis with soaring inflation and long-time low-cost borrowing coming to an abrupt end, but it was Covid that kicked things off.

This collection of economic disasters, almost certainly exacerbated by Covid, actually ended up forcing bookmakers to reduce their margin to an all time low of 14.65% in 2022.

Jump racing also fell to an all time low of 13.39%, but interestingly, margins on flat racing actually increased a little from 15.12% to 15.43%.

Flat racing does have higher margins than jump racing due to the greater number of runners in flat races, and that means bookies can more confidently increase margins here before they do so with jumps. Therefore, the fact that margins on flat racing actually turned a corner in 2022 show that bookmakers were testing the waters to see if they could get away with increasing their takings.

Covid then, was just another economic bump to navigate for the bookmakers, and while they did reduce their odds because of Covid, as soon as they feel they can increase them again without losing customers, they will do.

Will Margins Rise Again?

Undoubtedly. Eventually.

Undoubtedly. Eventually.

However, those 20%+ margins of the early 2000s are unlikely to come back.

That was the advent of online betting, which made it much easier for competing brands to come along and entice customers away from the established market leaders, which is why the margins fell so much at that time.

What happened with Covid, was that it came along just at the wrong time, just as the bookmakers were starting to creep things back up to a total average of around 17%-18%, which is where they were before the 2008 crash.

After years of sitting around the 15% mark, the bookies felt they could finally nudge things back towards their previous profit margin levels, then Covid hit and not only put and end to their plans, but forced them to drop margins further.

Barring another national disaster though, the only was is up for margins on horse racing.